The Global Artificial Intelligence (AI) in Insurance Market Ecosystem was valued at USD 800 Mn in 2018 and is expected to reach USD 4.5 Bn in 2026, growing at a CAGR of 24% by 2026. AI in Insurance Market is disrupting every phase in the value chain of insurance including virtual agent and chatbots that provide customized product recommendations and manage customer service inquiries. It also makes automated claims processing and claims estimates more quickly and accurately. InsurTech is using AI capabilities to create a new range of innovative products, such as instantly customizable life insurance and on-demand property coverage. While some key insurance companies are investing aggressively in AI, most insurers are moving slowly, as they are not sure about how to deploy these technologies in the best possible way. In 2018, only 51% of insurance executives claimed AI technologies to be extremely or very important to their company's success. But as compared to other industries, this number was very small.

Artificial Intelligence in Insurance Market is expanding at a faster rate to a wider range of countries. Insurance companies like Insurify, Ccc, Lemonade, Zest Finance, Clear cover, and Fly reel have already started using AI technology in Insurance claim, payments, and recommendations. AI can change the outlook of the business model of an insurer by enhancing the speed at which tasks can be carried out with the help of Robotic Process Automation (RPA). RPA helps in reducing repeatable tasks from operational teams and in performing more complex actions It also helps in optimizing the services insurers can provide to customers, brokers, and other external third parties, based on their relationships, preferences, and past interactions.

Get a Sample Copy of the report at https://www.alltheresearch.com/sample-request/390

Even though it is difficult to predict the full utilization of Artificial Intelligence in Insurance Market and replace specific actions with automated intelligent machines, market leaders are optimistic and confident about the benefits they can derive from its involvement. AI will increase labor productivity by 30 to 35% in 11 western industrialized countries and Japan by 2035. Economic growth is expected to be doubled by 2035. Considering the current scenario, AI-based products will include insurance coverage for smart driverless cars, smart sensors and factories, and cybercrime damages. Additionally, AI will also empower key insurance processes like claims analysis, asset management, risk calculation, and prevention. For example, property damage assessment can be done via the image processing feature of Artificial Intelligence in Insurance. The same machine can be used to make an informed decision about investments based on smart systems.

|

Application |

Devices |

Components |

Technology |

Deployment |

Offering |

|

Chatbots & Virtual Assistance |

Smartphones & Tablets |

CPU |

Machine learning |

Cloud |

Solutions |

|

Fraud Detection |

Wearables |

GPU |

Natural Language Process |

On-Premise |

Services |

|

Customer Relationship Management |

Surveillance systems |

Microprocessor |

Computer Vision |

|

|

|

Cybersecurity |

Workstations |

FPGA |

Context Awareness |

|

|

|

Payment Gateways |

Autonomous Robots |

Memory |

Others |

|

|

|

Financial Transactions |

UAV’S/Drones |

Storage |

|

|

|

|

Other |

|

Modules |

|

|

|

At the regional level, EMEA recorded moderate growth in the Property and Casualty Insurance (P&C) and health insurance segments. Growth in the American region has been characterized by strong progress in the health insurance segment and moderate growth in the P&C segment. Life insurance is expected to be a bit unpredictable, owing to changes in US regulations. On the other hand, in APAC, the insurance industry grew in all three segments in 2019, with the health insurance segment generating double-digit growth.

In the life insurance segment, most regions, except the Americas and Western Europe, noticed growth in 2019, but the extent of the growth, as well as the factors responsible for it, varied by region. It is observed that since 2018, Asian countries such as China, Hong Kong, and India have achieved the strongest gains in life insurance segment. Property & casualty insurance has remained stable over the past five years, growing at a rate of 4-5%. It is also expected to grow at 4.2% for the year 2020. At the regional level, the APAC region accounts for only 23%. The P&C insurance market has been the key driver of growth, growing at an average rate of 9% per annum (p.a.) and is estimated to grow even faster in the future.

There are many trends that are having an impact on the Artificial Intelligence in Insurance market forecast. These, when evaluated from a company’s perspective, can drive growth. Our numerous consulting projects have generated sizeable synergies across all regions and all sizes of companies.

|

Company |

Ecosystem Positioning |

Total Revenue |

Industry |

Region |

|

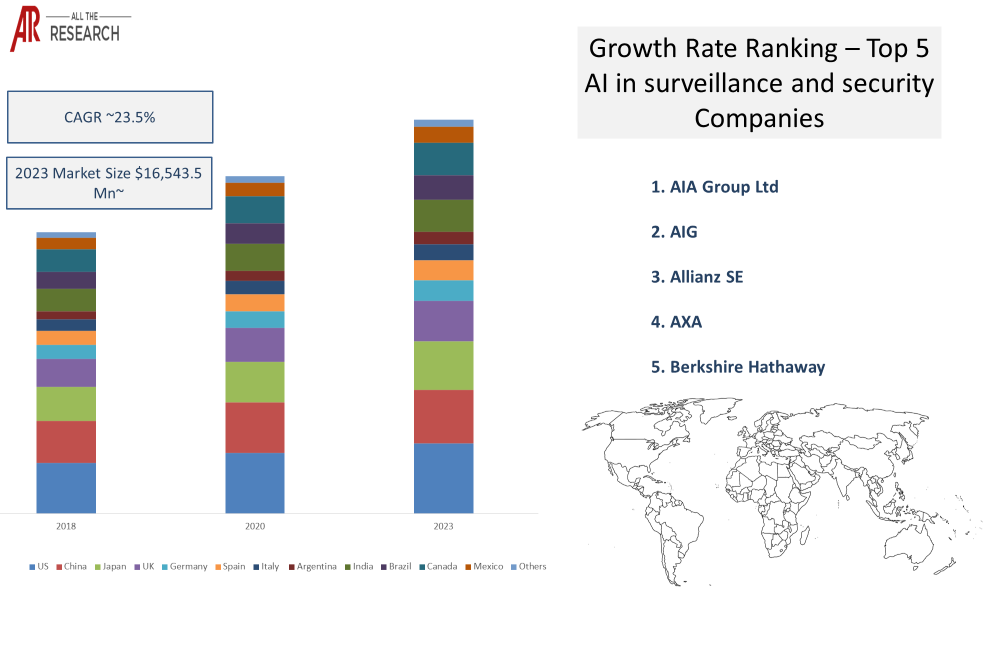

AIA Group Ltd |

Product Provider |

$230 billion |

Financial Services |

Global |

|

AIG |

Product Provider |

$0.006 billion |

Financial Services |

Global |

|

Allianz SE |

Product Provider |

$144.7 billion |

Financial Services |

Global |

|

AXA |

Product Provider |

$ 114.1 billion |

Financial Services |

Global |

|

Berkshire Hathaway |

Product Provider |

$247.5 billion |

Financial Services |

Global |

Very few markets have interconnectivity with other markets like AI. Our Interconnectivity module focuses on the key nodes of heterogenous markets in detail. Data analytics, Cloud Logistics, Machine learning, and computer vision markets are some of our key researched markets.

|

Trends |

Application |

Technology |

Deployment |

Offering |

Impact |

|

Top Chinese banks have introduced two chat assistants, of which one is for answering general queries like banking products and services, especially about mortgage, personal loan, credit card, medical insurance, and travel insurance services, while the other is embedded in Facebook Messenger and it lets customers search for dining discounts and makes recommendations based on consumer preference. Both assistants can communicate in Chinese, English, Cantonese, and a mix of Chinese and English, and use machine learning and natural language processing to continuously improve their abilities to answer customer queries. |

NLP |

Solutions |

0.57% |

||

|

Chatbots for customer service: Virtual assistants and chatbots can help answer customers' questions regarding auto insurance by using what seems to be natural language processing. The user of the customer service app can message or speak to the software to make enquiry about policy coverage and view billing information and direct them to the appropriate section of their insurance application. |

Chatbots & Virtual Assistants |

Services |

1.05% |

||

|

The use of machine vision will help insurance agencies automate the claims process. Insurance agents can upload images associated with the claim such as those of a damaged car and estimate how much they think the client should receive as a pay-out based on the photographed damage. AI can then compare the uploaded image to a database of various images labelled with varying degrees of damage and the payouts associated with them. The software checks if the insurance agent’s payout estimate is more than the payout that other clients received for similarly damaged vehicles. If so, it displays a warning to the agent to decrease the pay-out. As a result, the software can reduce the amount of excess money distributed to a client when agents pay claims. |

Machine vision |

Cloud |

|

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

1. Introduction

1.1. Global Artificial Intelligence Insurance Ecosystem Definition

1.2. Scope of study

1.3. Research Methodology

1.4. Assumptions/ Inferences

1.5. Sources

1.5.1. Primary Interviews

1.5.2. Secondary Sources

1.5.2.1. Key Secondary Webpages

1.5.2.2. Whitepapers

1.5.2.3. Annual Reports

1.5.2.4. Investor/Analyst Presentations

1.5.2.5.

1.6. About FABRIC

2. Executive Summary

Ecosystem Positioning

3. Global Artificial Intelligence Insurance Ecosystem Snapshot

3.1. Global Artificial Intelligence Insurance Ecosystem Segmentation

3.1.1. By Application

3.1.1.1. Chatbots & Virtual Assistance

3.1.1.2. Fraud Detection

3.1.1.3. Customer Relationship Management

3.1.1.4. Cybersecurity

3.1.1.5. Payment Gateways

3.1.1.6. Financial Transactions

3.1.1.7. Other

3.1.2. By Product, Parts & Devices

3.1.2.1. Smartphones & Tablets

3.1.2.2. Wearables

3.1.2.3. Surveillance systems

3.1.2.4. Workstations

3.1.2.5. Autonomous Robots

3.1.2.6. UAV’S/Drones

3.1.3. By Components

3.1.3.1. CPU

3.1.3.2. GPU

3.1.3.3. Microprocessor

3.1.3.4. FPGA

3.1.3.5. Memory

3.1.3.6. Storage

3.1.3.7. Modules

3.1.4. By Deployment

3.1.4.1. Cloud

3.1.4.2. On-Premise

3.1.5. By Offering

3.1.5.1. Solutions

3.1.5.2. Services

3.2. Global Artificial Intelligence Insurance ecosystem Broad Heads

4. Competitive Landscape Mapping by Ecosystem Positioning

4.1. Company by each node

4.2. Vendor Landscaping

5. Ecosystem Level Analysis

Trend Analysis

6. Global Artificial Intelligence Insurance ecosystem Trends

6.1. Short Term

6.1.1. Trend Description

6.1.2. Trend Evaluation

6.1.3. Trend Outlook

6.1.4. Trend Company Mapping

6.1.5. Related Global Artificial Intelligence Insurance ecosystem Mapping

6.1.6. Trend Region/Country Mapping

6.2. Mid Term

6.2.1. Trend Description

6.2.2. Trend Evaluation

6.2.3. Trend Outlook

6.2.4. Trend Company Mapping

6.2.5. Related Global Artificial Intelligence Insurance ecosystem Mapping

6.2.6. Trend Region/Country Mapping

6.3. Long Term

6.3.1. Trend Description

6.3.2. Trend Evaluation

6.3.3. Trend Outlook

6.3.4. Trend Company Mapping

6.3.5. Related Global Artificial Intelligence Insurance ecosystem Mapping

6.3.6. Trend Region/Country Mapping

Global Artificial Intelligence Insurance ecosystem Analysis

6.4. Regulatory Analysis

Global Artificial Intelligence Insurance ecosystem Developments

6.5. Global Artificial Intelligence Insurance ecosystem Events & Rationale

6.5.1. R&D, Technology and Innovation

6.5.2. Business & Corporate advancements

6.5.3. M&A, JVs/Partnerships

6.5.4. Political, Macro-economic, Regulatory

6.5.5. Awards & Recognition

6.5.6. Others

6.6.

Global Artificial Intelligence Insurance ecosystem Sizing, Volume and ASP Analysis & Forecast

7. Global Artificial Intelligence Insurance ecosystem Sizing & Volume

7.1. Cross-segmentation

7.2. Global Artificial Intelligence Insurance ecosystem Sizing and Global Artificial Intelligence Insurance ecosystem Forecast

7.3. Global Artificial Intelligence Insurance ecosystem Volume Analysis

7.4. Average Selling Price Analysis

7.5. Global Artificial Intelligence Insurance ecosystem Growth Analysis

Competitive Intelligence

8. Competitive Intelligence

8.1. Top Industry Players vs Trend Tagging

8.1.1.1. Importance

8.1.1.2. Trend Nature (Positive/ Negative)

8.1.1.3. Value

8.1.1.4. Interconnectivity for each vendor

8.2. Global Artificial Intelligence Insurance ecosystem Share Analysis

8.2.1.1. By Each Node

8.3. Strategies Adopted by Global Artificial Intelligence Insurance ecosystem participants

8.3.1.1. Global Artificial Intelligence Insurance ecosystem Strategies

8.3.1.2. New product launch Strategies

8.3.1.3. Geographic Expansion Strategies

8.3.1.4. Product-line Expansion Strategies

8.3.1.5. Operational / Efficiency building Strategies

8.3.1.6. Other Strategies

Company Profiles

9. Company Profiles - including the:

9.1. Berkshire Hathaway

9.1.1. Company Fundamentals

9.1.2. Subsidiaries list

9.1.3. Share Holding Pattern

9.1.4. Key Employees and Board of Directors

9.1.5. Financial Analysis

9.1.5.1. Financial Summary

9.1.5.2. Ratio Analysis

9.1.5.3. Valuation Metrics

9.1.6. Product & Services

9.1.7. Client & Strategies

9.1.8. Ecosystem Presence

9.1.9. SWOT

9.1.10. Trends Mapping

9.1.11. Analyst Views

9.2. AIA Group Ltd

9.3. AIG

9.4. Allianz SE

9.5. AXA

Customizations

10. Ask for Customization

10.1. Sensitivity Analysis

10.2. TAM SAM SOM Analysis

10.3. Other Customization

11. Appendix

11.1. Sources

11.2. Assumptions

11.3. Contact