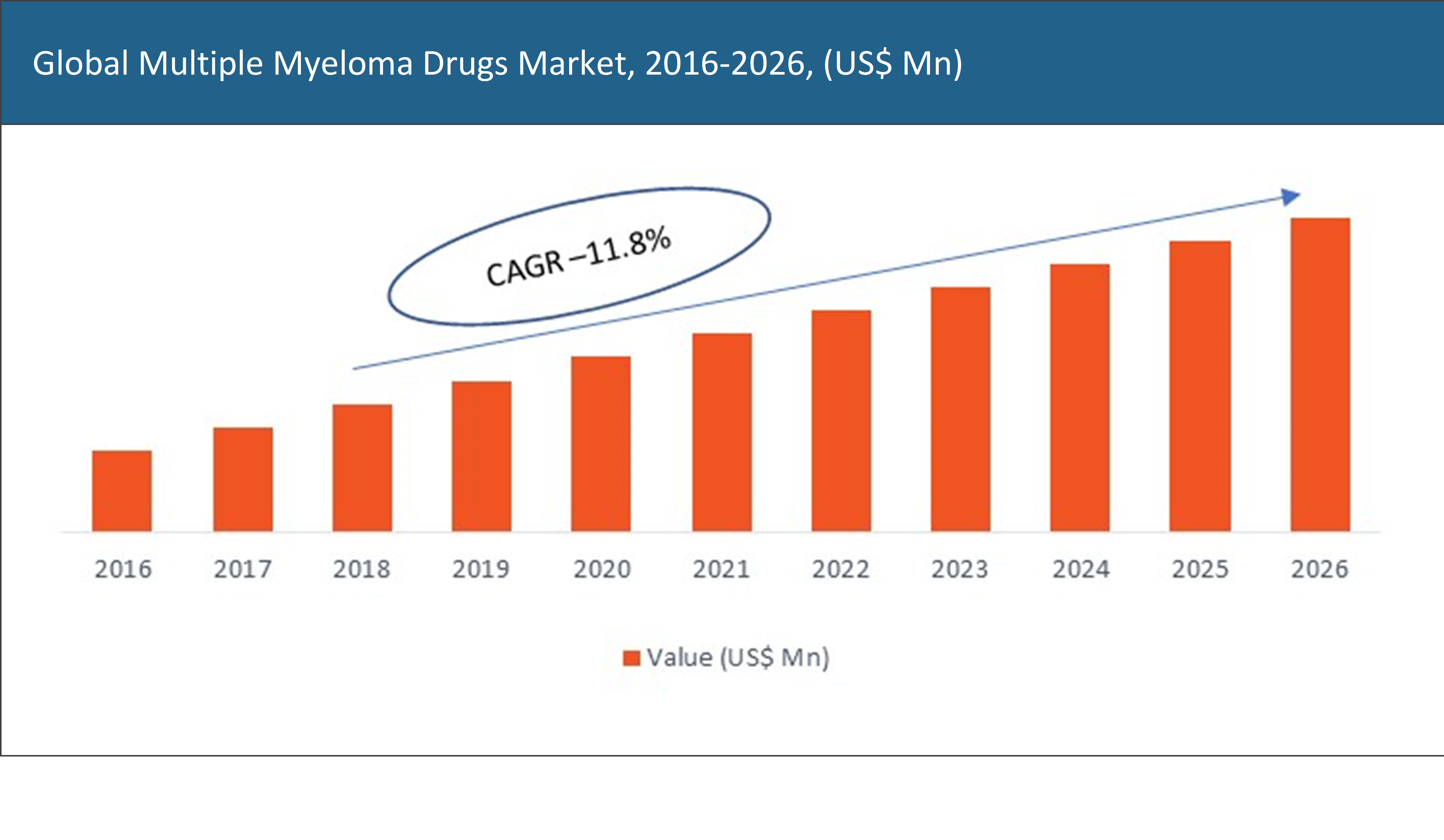

The global multiple myeloma drugs market was valued at approximately US$ XX Mn in the year 2018 and is expected to reach US$ XX Mn by the year 2026, growing at a CAGR of 11.8%.

The increasing prevalence of multiple myeloma is one of the major factors that is driving the growth of the multiple myeloma drugs market. Multiple Myeloma is the second most common haematological cancer. It forms in the plasma cells. Plasma cells are an important part of the immune system and are responsible for making antibodies that help fight against infections and other diseases.

The global burden of multiple myeloma has been increasingly uniformly for the last 3 decades. In the year 2016, there were around 130,000 cases of multiple myeloma globally, and approximately, 98,000 deaths occurred in the same year. Even after the approval of effective treatment options, the disease remains incurable in a vast patient pool, resulting in a substantial disease burden.

Apart from this, the launch of new therapeutic drugs and the active clinical pipeline for multiple myeloma treatment will also drive the market during the forecast period. For instance, in February 2019, Sanofi announced the results of Phase III clinical trials of isatuximab, its anti-CD38 therapy for the treatment of multiple myeloma.

However, the patent expiry of key multiple myeloma drugs is expected to impede the growth of the market.

The global multiple myeloma drugs market report covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market. An in-depth analysis of the regional and country level market at the various segment and sub-segment levels has been provided. The report comprises a competitive analysis of the key players functioning in the market and covers in-depth data related to the competitive landscape of the market and the recent strategies & product launches that will assist or affect the market in the near future.

Immunomodulating agents dominated the multiple myeloma drugs market

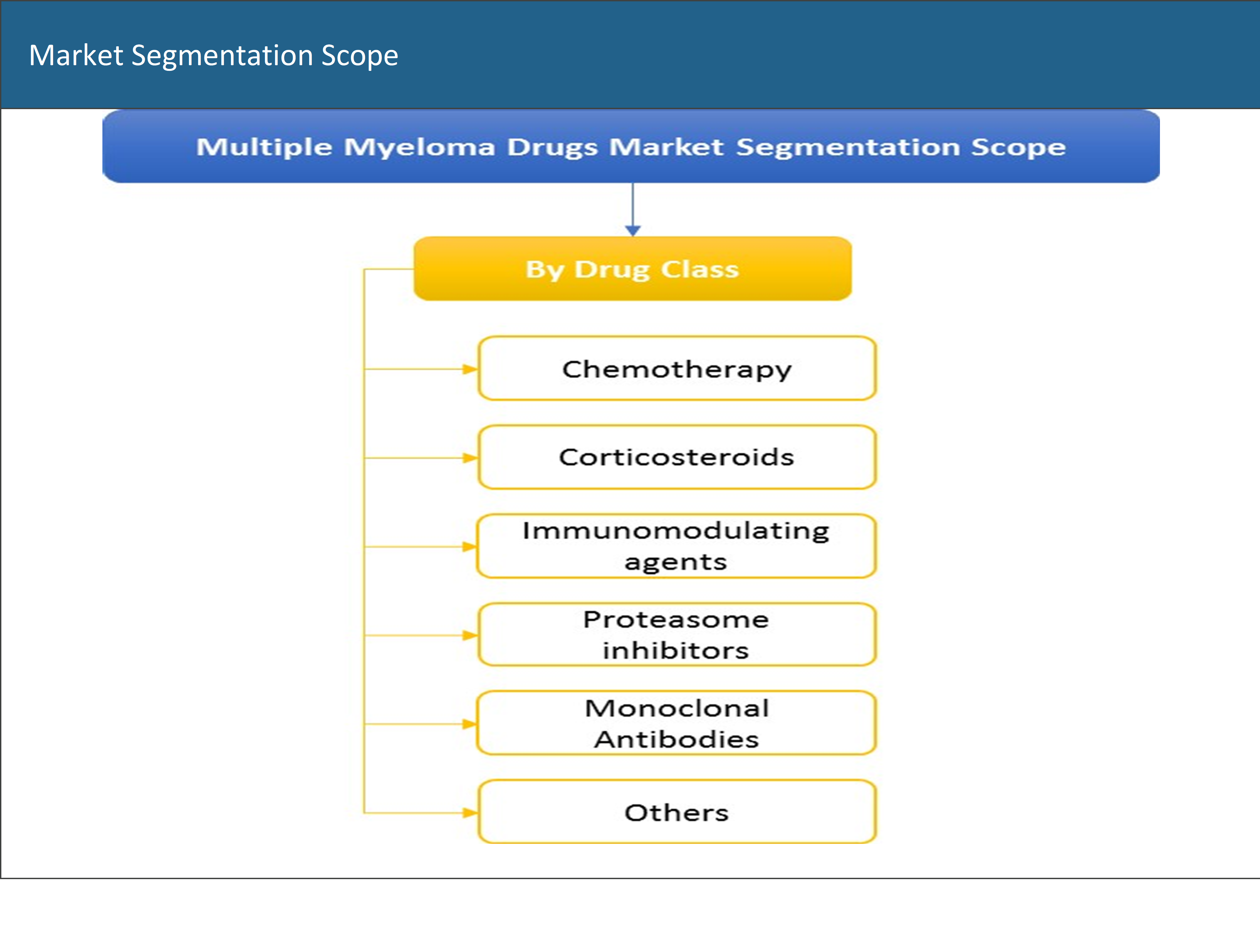

Based on the drug class, the multiple myeloma drugs market has been segmented into chemotherapy drugs, corticosteroids, immunomodulating agents, proteasome inhibitors, monoclonal antibodies, and others.

Although the way in which immunomodulating agents affect the immune system isn’t clear, these drugs have been used for the effective treatment of multiple myeloma for the last two decades. The key drugs in this segment include thalidomide, lenalidomide, and pomalidomide.

Monoclonal antibodies are expected to grow with a significant CAGR during the forecast period. The monoclonal antibodies approved for the treatment of multiple myeloma are daratumumab and elotuzumab. The global net sales of DARZALEX (daratumumab) were around US$ 699 million in the first quarter of 2019. Currently, several clinical trials are being conducted for different monoclonal antibodies for the treatment of multiple myeloma.

Another class of drugs used for the treatment of multiple myeloma are proteasome inhibitors. Proteasome inhibitors act by controlling cell division. They work by stopping proteasomes (enzyme complexes) in cells from breaking down proteins that are essential for controlling cell division. Proteasome inhibitors such as Bortezomib, Carfilzomib, and Ixazomib have been approved for the treatment of multiple myeloma.

North America is to account for the largest market share throughout the forecast period

The high incidence of multiple myeloma in the United States is one of the major factors behind the dominance of North America in the multiple myeloma drugs market. The American Cancer Society estimates that approximately 32,110 new cases of multiple myeloma will be diagnosed in the United States in the year 2019, whereas 12,960 deaths are expected to occur in the same year.

Apart from this, the high adoption rate of newer therapeutic treatments, coupled with the favourable reimbursement scenario, will also drive the growth of this market. Also, most of the key drug manufacturers are present in this region.

However, the Asia-Pacific region is expected to show significant growth during the forecast period, owing to the rising patient base. Apart from this, the increasing adoption rate of novel therapies, coupled with the support from government as well as non-government organizations, is expected to drive the growth of the multiple myeloma drugs market in this region.

Key geographies covered:

North America

US

Canada

Europe

UK

Germany

France

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

Rest of APAC

Rest of the World

Latin America

Middle East & Africa

Company Profiles and Competitive Intelligence:

The major players operating in the multiple myeloma drugs market are Celgene Corporation (US), Janssen Biotech, Inc. (US), Bristol-Myers Squibb Company (US), Millennium Pharmaceuticals (US), Genzyme Corporation (US), Novartis AG (Switzerland), and Amgen, Inc. (US), amongst others.

Celgene Corporation is one of the major players in the multiple myeloma drugs market. The company’s key immunomodulating agents, Pomalyst (Pomalidomide) and Revlimid (Lenalidomide) have shown high treatment efficiency and are expected to drive the multiple myeloma drugs market. Revlimid® sales for the year 2018 were US$ 9.68 billion and an 18% year-on-year increase over the previous year.

The company is further expanding its multiple myeloma treatment portfolio by organic and inorganic methods. In January 2018, the company acquired Juno Therapeutics, Inc. The company Juno Therapeutics is a pioneer in the development of CAR-T cell therapies for the treatment of different types of cancers. Juno’s JCAR017 is a great fit with Celgene’s lymphoma program. It is the best-in-class CD-19 CAR-T for the treatment of relapsed or refractory diffuse large B-cell lymphoma (DLBCL).

Most of these companies are focussing on the development of combination therapies for the treatment of multiple myeloma.

Key questions answered:

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Multiple Myeloma Drugs Market, 2016-2026, (US$ Mn)

2.1 Market Snapshot: Global Multiple Myeloma Drugs Market

2.2 Market Dynamics

2.3 Global Multiple Myeloma Drugs Market, by Segment, 2018

2.3.1 Global Multiple Myeloma Drugs Market, by Drug Class, 2018 (US$ Mn)

2.3.2 Global Multiple Myeloma Drugs Market, by Region, 2018 (US$ Mn)

2.4 Premium Insights

2.4.1 Multiple Myeloma Drugs Market In Developed vs. Developing Economies, 2018 vs 2026

2.4.2 Global Multiple Myeloma Drugs Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Increasing incidence of multiple myeloma

3.2.2 Launch of new drugs for the treatment of multiple myeloma

3.3 Market Restraints

3.3.1 Patent Expiry of key multiple myeloma treatment drugs

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Increasing demand from emerging countries

3.4.2 Opportunity 2

3.5 Unmet clinical needs

3.6 Key pipeline drugs for multiple myeloma treatment

Chapter 4 Global Multiple Myeloma Drugs Market, by Drug Class

4.1 Market Overview, by Drug Class

4.1.1 Global Multiple Myeloma Drugs Market, by Drug Class, 2016-2026 (US$ Mn)

4.1.2 Incremental Opportunity, by Drug Class, From 2018-2026

4.2 Chemotherapy

4.2.1 Global Multiple Myeloma Drugs Market, by Chemotherapy, 2016-2026, (US$ Mn)

4.3 Corticosteroids

4.3.1 Global Multiple Myeloma Drugs Market, by Corticosteroids, 2016-2026, (US$ Mn)

4.4 Immunomodulating agents

4.4.1 Global Multiple Myeloma Drugs Market, by Immunomodulating agents, 2016-2026, (US$ Mn)

4.5 Proteasome inhibitors

4.5.1 Global Multiple Myeloma Drugs Market, by Proteasome inhibitors, 2016-2026, (US$ Mn)

4.6 Monoclonal Antibodies

4.6.1 Global Multiple Myeloma Drugs Market, by Monoclonal Antibodies, 2016-2026, (US$ Mn)

4.7 Others

4.7.1 Global Multiple Myeloma Drugs Market, by Others, 2016-2026, (US$ Mn)

Chapter 5 Global Multiple Myeloma Drugs Market, by Region

5.1 Market Overview, by Region

5.1.1 Global Multiple Myeloma Drugs Market, by Region, 2016-2026, (US$ Mn)

5.2 Attractive Investment Opportunity, by Region, 2018

5.3 North America Multiple Myeloma Drugs Market

5.3.1 North America Multiple Myeloma Drugs Market, by Drug Class, 2016-2026 (US$ Mn)

5.3.2 United States Country Profile

5.3.2.1 United States Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.3.3 Canada Country Profile

5.3.3.1 Canada Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.4 Europe Multiple Myeloma Drugs Market

5.4.1 Europe Multiple Myeloma Drugs Market, by Drug Class, 2016-2026 (US$ Mn)

5.4.2 United Kingdom Country Profile

5.4.2.1 United Kingdom Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.4.3 Germany Country Profile

5.4.3.1 Germany Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.4.4 France Country Profile

5.4.4.1 France Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.4.5 Italy Country Profile

5.4.5.1 Italy Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.4.6 Spain Country Profile

5.4.6.1 Spain Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.4.7 Rest of Europe

5.4.7.1 Rest of Europe Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.5 Asia Pacific Multiple Myeloma Drugs Market

5.5.1 Asia-Pacific Multiple Myeloma Drugs Market, by Drug Class, 2016-2026 (US$ Mn)

5.5.2 China Country Profile

5.5.2.1 China Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.5.3 Japan Country Profile

5.5.3.1 Japan Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.5.4 India Country Profile

5.5.4.1 India Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.5.5 South Korea Country Profile

5.5.5.1 South Korea Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.5.6 Rest of Asia Pacific

5.5.6.1 Rest of Asia Pacific Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.6 Rest of the World Multiple Myeloma Drugs Market

5.6.1 Rest of the World Multiple Myeloma Drugs Market, by Drug Class, 2016-2026 (US$ Mn)

5.6.2 Latin America

5.6.2.1 Latin America Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

5.6.3 Middle East & Africa

5.6.3.1 Middle East & Africa Multiple Myeloma Drugs Market, 2016-2026 (US$ Mn)

Chapter 6 Competitive Intelligence

6.1 Market Players Present in Market Life Cycle

6.2 Top 5 Players Comparison

6.3 Market Positioning of Key Players, 2018

6.4 Market Players Mapping

6.4.1 By Drug Class

6.4.2 By Region

6.5 Strategies Adopted by Key Market Players

6.6 Recent Developments in the Market

6.6.1 Mergers & Acquisitions, Partnership, New Product Developments

6.7 Operational Efficiency Comparison by Key Players

Chapter 7 Company Profiles

7.1 Celgene Corporation

7.1.1 Celgene Corporation Overview

7.1.2 Key Stakeholders/Person in Celgene Corporation

7.1.3 Celgene Corporation Products Portfolio

7.1.4 Celgene Corporation Financial Overview

7.1.5 Celgene Corporation News/Recent Developments

7.2 Janssen Biotech, Inc.

7.2.1 Janssen Biotech, Inc. Overview

7.2.2 Key Stakeholders/Person in Janssen Biotech, Inc.

7.2.3 Janssen Biotech, Inc. Products Portfolio

7.2.4 Janssen Biotech, Inc. Financial Overview

7.2.5 Janssen Biotech, Inc. News/Recent Developments

7.3 Bristol-Myers Squibb

7.3.1 Bristol-Myers Squibb Overview

7.3.2 Key Stakeholders/Person in Bristol-Myers Squibb

7.3.3 Bristol-Myers Squibb Products Portfolio

7.3.4 Bristol-Myers Squibb Financial Overview

7.3.5 Bristol-Myers Squibb News/Recent Developments

7.4 Genzyme Corporation

7.4.1 Genzyme Corporation Overview

7.4.2 Key Stakeholders/Person in Genzyme Corporation

7.4.3 Genzyme Corporation Products Portfolio

7.4.4 Genzyme Corporation Financial Overview

7.4.5 Genzyme Corporation News/Recent Developments

7.5 Amgen, Inc.

7.5.1 Amgen, Inc. Overview

7.5.2 Key Stakeholders/Person in Amgen, Inc.

7.5.3 Amgen, Inc. Products Portfolio

7.5.4 Amgen, Inc. Financial Overview

7.5.5 Amgen, Inc. News/Recent Developments

7.6 Novartis AG

7.6.1 Novartis AG Overview

7.6.2 Key Stakeholders/Person in Novartis AG

7.6.3 Novartis AG Products Portfolio

7.6.4 Novartis AG Financial Overview

7.6.5 Novartis AG News/Recent Developments

7.7 Millennium Pharmaceuticals, Inc.

7.7.1 Millennium Pharmaceuticals, Inc. Overview

7.7.2 Key Stakeholders/Person in Millennium Pharmaceuticals, Inc.

7.7.3 Millennium Pharmaceuticals, Inc. Products Portfolio

7.7.4 Millennium Pharmaceuticals, Inc. Financial Overview

7.7.5 Millennium Pharmaceuticals, Inc. News/Recent Developments