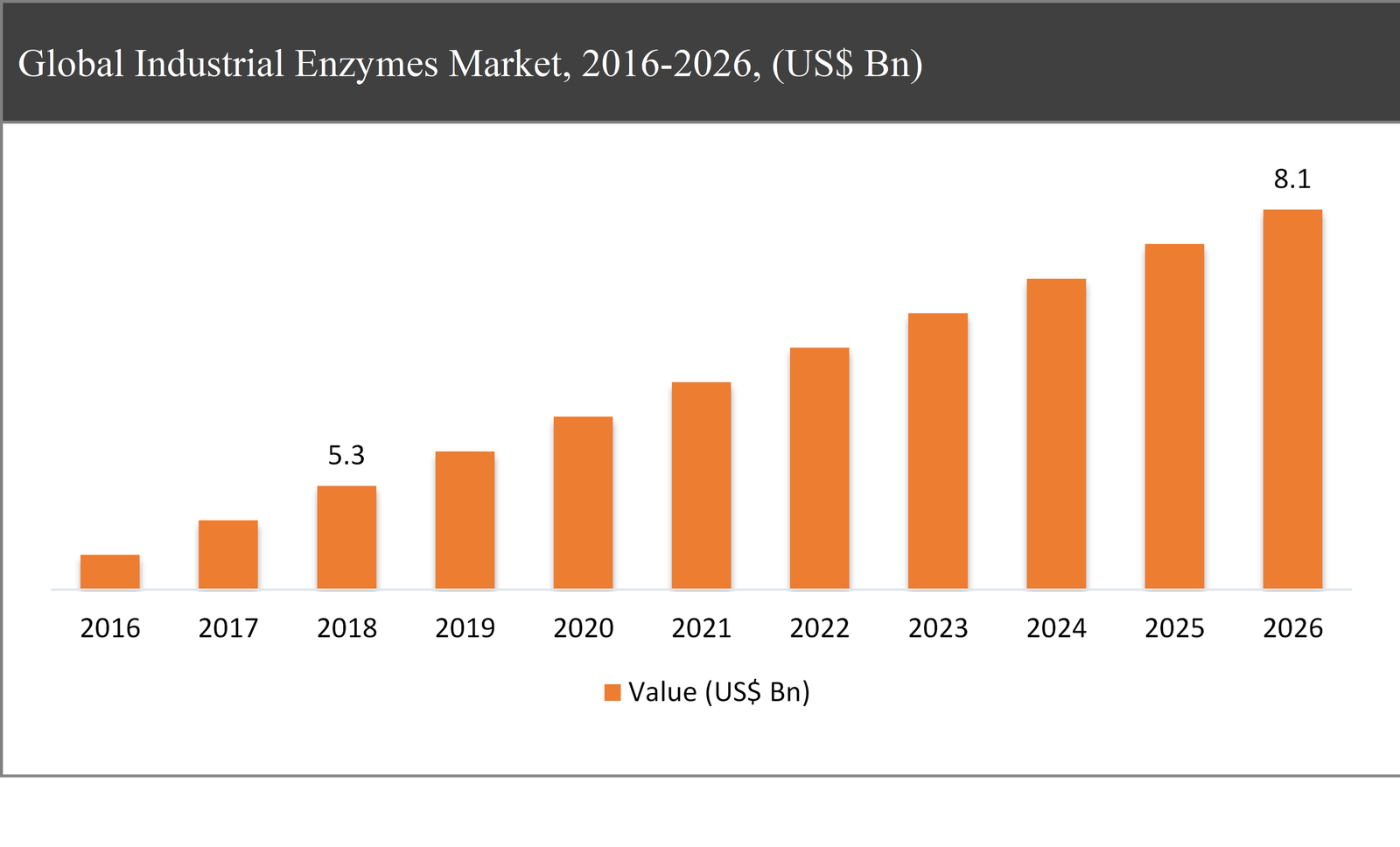

The global industrial enzymes market was valued at USD 5.3 billion in 2018 and is expected to reach USD 8.1 billion in 2026, growing at a CAGR of 5.8% during the forecast period.

Industrial enzymes are biological catalysts used to boosts the production processes and increase chemical reactions. The industrial enzymes are used in various industrial and chemical applications which include brewing, tanning, baking, and animal feed & biofuel production. Based on applications, different types of enzymes such as cellulases, amylases, proteases, phytases, and lipases are used.

Industrial Enzymes Market Segmentation |

|

| By Type | 1. Amylases |

| 2. Animal Feed | |

| 3. Lipases | |

| 4. Phytases | |

| 5. Others | |

| By Source | 1. Micro-Organisms |

| 2. Plants | |

| 3. Animals | |

| By Application | 1. Food & Beverages |

| 2. Cleaning agents | |

| 3. Animal Feed | |

| 4. Others | |

| By Region | 1. North America (US and Canada) |

| 2. Europe (UK, Germany, France and Rest of Europe) | |

| 3. Asia Pacific (China, Japan, India and Rest of Asia Pacific) | |

| 4. Latin America (Brazil, Mexico and Rest of Latin America) | |

| 5. Middle East & Africa (GCC and Rest of Middle East & Africa) | |

The growth of the industrial enzymes market is primarily driven by the rising enzymes demand from food & beverage, nutraceutical, and textile applications, increase in the consumption of processed food and packaged food across the globe, and multi-functionality of industrial enzymes. Furthermore, increase in demand of enzymes in packaged foods and growing demand for personal care products and cosmetics, such as skin repair creams, toothpaste, mouthwashes, and whiteners, is estimated to boost the market growth. Moreover, changing lifestyles of consumers across developed countries, growing pharmaceutical and food industry, technological advancement, and increase in the number of applications, and alternative to synthetic chemicals are expected to create opportunities for the manufacturers in the global market over the forecast period. However, stringent government regulations in industrial production and safety & quality concerns of products are expected to hamper the growth of the global industrial enzymes market in the coming years.

The protease segment expected to dominate the market throughout the forecast period

Based on the type, the global industrial enzymes market has been segmented into amylases, cellulases, proteases, lipases, phytases, and others. The protease segment accounted for approximately 37% of the share in the global industrial enzymes market in 2018.

Increase of protease enzymes in the food and beverage industry in the production of a variety of sugar syrups and prebiotics is further expected to raise segment over the forecast period.

Based on the application, the food & beverages segment is expected to grow at a CAGR of around 6.2% throughout the forecast period

Based on the application, the market has been segmented into food & beverages, cleaning agents, animal feed, and others. The food & beverages segment accounts of the largest share in the market and are expected to grow at a CAGR of around 6.2% during the forecast period.

Food enzymes enhance the shelf life and quality of products which grows the demand for enzymes in food & beverage applications. The manufacturers BASF SE DowDuPont, Associated British Foods plc, Koninklijke DSM N.V., and Novozymes A/S are the mainly investing in the development of industrial enzymes for the food & beverages application, which expected the lead the market in the coming years.

Based on the source, the micro-organisms segment is expected to dominate during the forecast period

Based on the source, the market has been segmented into micro-organisms, plants, and animals. The micro-organisms segment accounts of the largest share in the market and held for more than 45% of the total market in 2018. The major factors that are driving the growth of this segment are the rising demand micro-organisms for commercial enzyme production and economic, effective, and have a controllable enzyme content. This expected to enhance the dominance of the micro-organisms segment in the global market over the forecast period.

North America to dominate the industrial enzymes market throughout the forecast period

North America accounted for nearly 35% share of the global industrial enzymes market in 2018 and is expected to dominate the market throughout the forecast period. The rapid consumption of enzymes in various end-user industries enhanced productivity, and better product value is the major driving factor for the region in the global market. Moreover, the increasing demand for nutritional & healthy products and diversification in the region’s food sector are expected to enhance the market growth in the global industrial enzymes market in future.

Asia Pacific is expected to hold the highest CAGR in the global market during the forecast period. The manufacturers are investing in developing countries to meet the demand for industrial enzymes. Moreover, rapid industrialization in countries, such as China, Korea, Thailand, Japan, and India, are expected to enhance the market growth in the global industrial enzymes market during the forecast.

Company Profiles and Competitive Intelligence:

The major players operating in the global industrial enzymes market are BASF SE (Germany), DowDuPont (US), Associated British Foods plc (UK), Koninklijke DSM N.V. (Netherlands), and Novozymes A/S (Germany), Dyadic International Inc. (US), Advanced Enzyme Technologies Ltd (India), Adisseo (China), Chr. Hansen Holding A/S (Denmark), and Amano Enzyme Inc. (US) among others.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

TABLE OF CONTENT

Chapter 1 Executive Summary

1.1. Market Summary

1.1.1. Global Industrial Enzymes Market, 2016-2026, (USD Bn)

1.2. Market Snapshot: Global Industrial Enzymes Market

1.3. Market Dynamics

1.4. Global Industrial Enzymes Market, by Segment, 2018

1.4.1. Global Industrial Enzymes Market, by Type, 2018, (USD Bn)

1.4.2. Global Industrial Enzymes Market, by Source, 2018, (USD Bn)

1.4.3. Global Industrial Enzymes Market, by Application, 2018, (USD Bn)

1.4.4. Global Industrial Enzymes Market, by Region, 2018 (USD Bn)

1.5. Premium Insights

1.5.1. Industrial Enzymes Market In Developed Vs. Developing Economies, 2018 vs 2023

1.5.2. Global Industrial Enzymes Market: Regional Life Cycle Analysis

Chapter 2 Market Dynamics

2.1. Market Overview

2.2. Market Drivers

2.2.1. Growing Demand for Food and Beverage Products

2.2.2. Growing applications of industrial enzymes

2.3. Market Restraints

2.3.1. Stringent government regulations in industrial production

2.3.2. Safety & quality concerns of products

2.4. Market Opportunities

2.4.1. Technological advancement and increase in the number of applications

2.4.2. Alternative to synthetic chemicals

2.5. Industry Value Chain Analysis

2.6. Pricing Analysis

2.7. Porter’s Five Forces Analysis

Chapter 3 Global Industrial Enzymes Market, by Type

3.1. Market Overview, by Type

3.1.1. Global Industrial Enzymes Market, by Type, 2016-2026 (USD Bn)

3.1.2. Incremental Opportunity, by Type, 2018

3.2. Amylases

3.2.1. Global Industrial Enzymes Market, by Amylases, 2016-2026, (USD Bn)

3.3. Proteases

3.3.1. Global Industrial Enzymes Market, by Proteases, 2016-2026, (USD Bn)

3.4. Lipases

3.4.1. Global Industrial Enzymes Market, by Lipases, 2016-2026, (USD Bn)

3.5. Phytases

3.5.1. Global Industrial Enzymes Market, by Phytases, 2016-2026, (USD Bn)

3.6. Others

3.6.1. Global Industrial Enzymes Market, by Others, 2016-2026, (USD Bn)

Chapter 4 Global Industrial Enzymes Market, by Source

4.1. Market Overview, by Source

4.1.1. Global Industrial Enzymes Market, by Source, 2016-2026 (USD Bn)

4.1.2. Incremental Opportunity, by Source, 2018

4.2. Micro-Organisms

4.2.1. Global Industrial Enzymes Market, by Micro-Organisms, 2016-2026, (USD Bn)

4.3. Plants

4.3.1. Global Industrial Enzymes Market, by Plants, 2016-2026, (USD Bn)

4.4. Animals

4.4.1. Global Industrial Enzymes Market, by Animals, 2016-2026, (USD Bn)

Chapter 5 Global Industrial Enzymes Market, by Application

5.1. Market Overview, by Application

5.1.1. Global Industrial Enzymes Market, by Application, 2016-2026 (USD Bn)

5.1.2. Incremental Opportunity, by Application, 2018

5.2. Food & Beverages

5.2.1. Global Industrial Enzymes Market, by Food & Beverages, 2016-2026, (USD Bn)

5.3. Cleaning Agents

5.3.1. Global Industrial Enzymes Market, by Cleaning Agents, 2016-2026, (USD Bn)

5.4. Animal Feed

5.4.1. Global Industrial Enzymes Market, by Animal Feed, 2016-2026, (USD Bn)

5.5. Others

5.5.1. Global Industrial Enzymes Market, by Others, 2016-2026, (USD Bn)

Chapter 6 Global Industrial Enzymes Market, by Region

6.1. Market Overview, by Region

6.1.1. Global Industrial Enzymes Market, by Region, 2016-2026, (USD Bn)

6.2. Attractive Investment Opportunity, by Region, 2018

6.3. North America Industrial Enzymes Market

6.3.1. North America Industrial Enzymes Market, by Type, 2016-2026 (USD Bn)

6.3.2. North America Industrial Enzymes Market, by Source, 2016-2026 (USD Bn)

6.3.3. North America Industrial Enzymes Market, by Application, 2016-2026 (USD Bn)

6.3.4. United States Industrial Enzymes Market, 2016-2026 (USD Bn)

6.3.5. Canada Industrial Enzymes Market, 2016-2026 (USD Bn)

6.4. Europe Industrial Enzymes Market

6.4.1. Europe Industrial Enzymes Market, by Type, 2016-2026 (USD Bn)

6.4.2. Europe Industrial Enzymes Market, by Source, 2016-2026 (USD Bn)

6.4.3. Europe Industrial Enzymes Market, by Application, 2016-2026 (USD Bn)

6.4.4. United Kingdom Industrial Enzymes Market, 2016-2026 (USD Bn)

6.4.5. Germany Industrial Enzymes Market, 2016-2026 (USD Bn)

6.4.6. France Industrial Enzymes Market, 2016-2026 (USD Bn)

6.4.7. Rest of Europe Industrial Enzymes Market, 2016-2026 (USD Bn)

6.5. Asia Pacific Industrial Enzymes Market

6.5.1. Asia Pacific Industrial Enzymes Market, by Type, 2016-2026 (USD Bn)

6.5.2. Asia Pacific Industrial Enzymes Market, by Source, 2016-2026 (USD Bn)

6.5.3. Asia Pacific Industrial Enzymes Market, by Application, 2016-2026 (USD Bn)

6.5.4. China Industrial Enzymes Market, 2016-2026 (USD Bn)

6.5.5. Japan Industrial Enzymes Market, 2016-2026 (USD Bn)

6.5.6. India Industrial Enzymes Market, 2016-2026 (USD Bn)

6.5.7. Rest of Asia Pacific Industrial Enzymes Market, 2016-2026 (USD Bn)

6.6. Latin America Industrial Enzymes Market

6.6.1. Latin America Industrial Enzymes Market, by Type, 2016-2026 (USD Bn)

6.6.2. Latin America Industrial Enzymes Market, by Source, 2016-2026 (USD Bn)

6.6.3. Latin America Industrial Enzymes Market, by Application, 2016-2026 (USD Bn)

6.6.4. Brazil Industrial Enzymes Market, 2016-2026 (USD Bn)

6.6.5. Mexico Industrial Enzymes Market, 2016-2026 (USD Bn)

6.6.6. Rest of Latin America Industrial Enzymes Market, 2016-2026 (USD Bn)

6.7. Middle East & Africa Industrial Enzymes Market

6.7.1. Middle East & Africa Industrial Enzymes Market, by Type, 2016-2026 (USD Bn)

6.7.2. Middle East & Africa Industrial Enzymes Market, by Source, 2016-2026 (USD Bn)

6.7.3. Middle East & Africa Industrial Enzymes Market, by Application, 2016-2026 (USD Bn)

6.7.4. GCC Industrial Enzymes Market, 2016-2026 (USD Bn)

6.7.5. Rest of Middle East & Africa Industrial Enzymes Market, 2016-2026 (USD Bn)

Chapter 7 Competitive Intelligence

7.1. Top 5 Players Comparison

7.2. Market Positioning of Key Players, 2018

7.3. Market Players Mapping

7.3.1. By Type

7.3.2. By Source

7.3.3. By Application

7.3.4. By Region

7.4. Strategies Adopted by Key Market Players

7.5. Recent Developments in the Market

7.5.1. Mergers & Acquisitions, Partnership, New Type Developments

Chapter 8 Company Profiles

8.1. E. I. Du Pont De Nemours and Company

8.1.1. E. I. Du Pont De Nemours and Company Overview

8.1.2. E. I. Du Pont De Nemours and Company Types Portfolio

8.1.3. E. I. Du Pont De Nemours and Company Financial Overview

8.1.4. E. I. Du Pont De Nemours and Company News/Recent Developments

8.2. BASF SE

8.2.1. BASF SE Overview

8.2.2. BASF SE Types Portfolio

8.2.3. BASF SE Financial Overview

8.2.4. BASF SE News/Recent Developments

8.3. Associated British Foods PLC

8.3.1. Associated British Foods PLC Overview

8.3.2. Associated British Foods PLC Types Portfolio

8.3.3. Associated British Foods PLC Financial Overview

8.3.4. Associated British Foods PLC News/Recent Developments

8.4. Koninklijke DSM N.V.

8.4.1. Koninklijke DSM N.V. Overview

8.4.2. Koninklijke DSM N.V. Types Portfolio

8.4.3. Koninklijke DSM N.V. Financial Overview

8.4.4. Koninklijke DSM N.V. News/Recent Developments

8.5. Novozymes A/S

8.5.1. Novozymes A/S Overview

8.5.2. Novozymes A/S Types Portfolio

8.5.3. Novozymes A/S Financial Overview

8.5.4. Novozymes A/S News/Recent Developments

8.6. Dyadic International Inc.

8.6.1. Dyadic International Inc. Overview

8.6.2. Dyadic International Inc. Types Portfolio

8.6.3. Dyadic International Inc. Financial Overview

8.6.4. Dyadic International Inc. News/Recent Developments

8.7. Advanced Enzyme Technologies Ltd

8.7.1. Advanced Enzyme Technologies Ltd Overview

8.7.2. Advanced Enzyme Technologies Ltd Types Portfolio

8.7.3. Advanced Enzyme Technologies Ltd Financial Overview

8.7.4. Advanced Enzyme Technologies Ltd News/Recent Developments

8.8. Adisseo

8.8.1. Adisseo Overview

8.8.2. Adisseo Types Portfolio

8.8.3. Adisseo Financial Overview

8.8.4. Adisseo News/Recent Developments

8.9. Chr. Hansen Holding A/S

8.9.1. Chr. Hansen Holding A/S Overview

8.9.2. Chr. Hansen Holding A/S Types Portfolio

8.9.3. Chr. Hansen Holding A/S Financial Overview

8.9.4. Chr. Hansen Holding A/S News/Recent Developments

8.10. Amano Enzyme Inc.

8.10.1. Amano Enzyme Inc. Overview

8.10.2. Amano Enzyme Inc. Types Portfolio

8.10.3. Amano Enzyme Inc. Financial Overview

8.10.4. Amano Enzyme Inc. News/Recent Developments

Chapter 9 Preface

9.1. Data Triangulation

9.2. Research Methodology

9.2.1. Phase I – Secondary Research

9.2.2. Phase II – Primary Research

9.2.3. Phase III – Expert Panel Review

9.2.4. Approach Adopted

9.2.4.1. Top-Down Approach

9.2.4.2. Bottom-Up Approach

9.2.5. Supply- Demand side

9.2.6. Breakup of the Primary Profiles