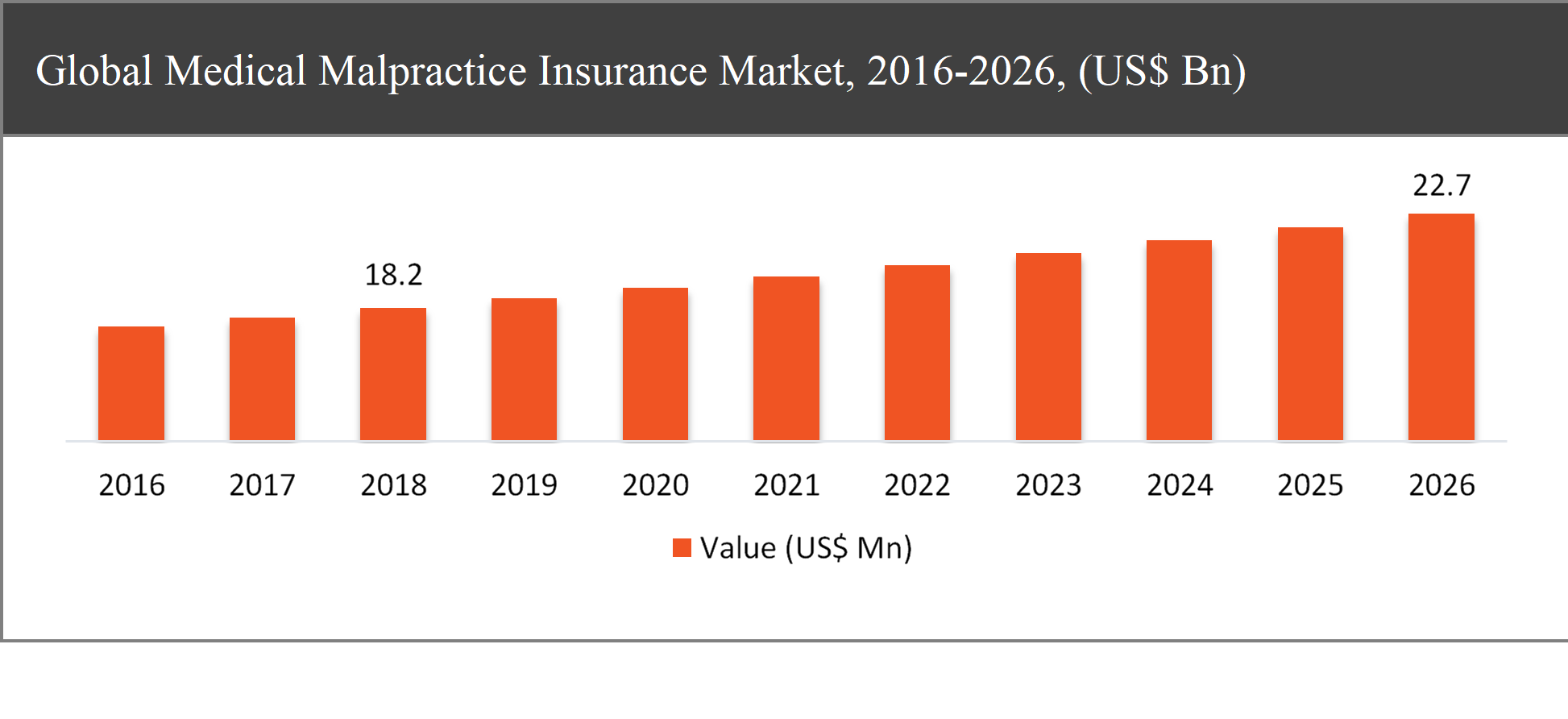

The global medical malpractice insurance market was valued at USD 18.2 billion in 2018 and is expected to reach USD 22.7 billion in 2026, growing at a CAGR of 3.2% during the forecast period.Medical malpractice insurance is also known as medical professional liability insurance. It is one type of professional liability insurance that protects physicians and other licensed health care professionals from liability related to wrongful perform resulting in bodily injury, property damage and, medical expenses and the cost of defending lawsuits related to such claims.

The growth of the medical malpractice insurance market is primarily driven by the increasing prevalence of various chronic diseases coupled with number surgeries across the globe. Moreover, increasing cases of medical malpractice during surgeries and other treatment processes. The adoption of advanced technology has been observed for surgeries. The trend towards robotics and high-precision instrumentation and the constant development of minimally invasive surgeries facilitates the surgeons to offer improved patient outcomes that further encourage the possibility of malpractice in surgeries. The rising number of surgeries for accidental injuries raises the demand for medical malpractice insurance. There are several surgeries such as elective surgery, emergency surgery, exploratory surgery, cosmetic surgery, and others are on the rise. Hip replacement surgeries increase the possibilities of malpractice that raise the demand for medical malpractice insurance across the globe.

Medical Malpractice Insurance Market Segmentation |

|

| By Type | 1. E&O Insurance |

| 2. D&O Insurance | |

| By Coverage | 1. Up To US$1 Million |

| 2. US$1 Million to US$5 Million | |

| 3. US$5 Million to US$20 Million | |

| 4. Above US$20 Million | |

| By Region | 1. North America (US and Canada) |

| 2. Europe (UK, Germany, France and Rest of Europe) | |

| 3. Asia Pacific (China, Japan, India and Rest of Asia Pacific) | |

| 4. Latin America (Brazil, Mexico and Rest of Latin America) | |

| 5. Middle East & Africa (GCC and Rest of Middle East & Africa) | |

E&O Insurance type segment expected to grow at the fastest rate of 4.8% CAGR during the forecast period

Based on type, the global medical malpractice insurance market has been segmented into E&O insurance and D&O insurance. E&O segment is projected to have the fastest market growth during the forecast period. Then market is mainly driven due to increasing errors and malpractice during medical practice as these type insurances provide coverage for people that give advice, make educated recommendations, design solutions or represent the requirements of others. It protects those individuals when they have done something they should not have or when they neglected to do something they should have.

Based on Coverage: US$1 Million to US$5 Million segments is expected to lead during the forecast period

Based on coverage, the market has been segmented into up to US$1 Million, US$1 Million to US$5 Million, US$5 Million to US$20 Million, and Above US$20 Million. The Coverage US$1 Million to US$5 Million segments are projected to have the largest share of 33% in the global market. The market is mainly driven by the increasing preference of medical experts for coverage US$1 Million to US$5 Million in medical industry as this provides substantial benefits than the other coverage.

North America to dominate the medical malpractice insurance market throughout the forecast period

North America accounted for nearly 36% share of the global medical malpractice insurance market in 2018 and is expected to dominate the market throughout the forecast period followed by Europe and Asia-Pacific. Factors that are contributing significantly to the market growth include well-developed healthcare infrastructure, increasing healthcare insurance investments, high healthcare expenditure and so on. Moreover, the market growth is attributed to the rising prevalence of chronic diseases. North America is one of the strongest economies globally, comprising around 23.3% of the world economy as per International Monetary Fund in 2017. According to data from OECD, in 2016 the US spent almost 17.2% of GDP on healthcare expenditure, whereas Canada spent 10.6% of GDP on healthcare. Asia-Pacific accounted for the highest CAGR in the global medical malpractice insurance market during the forecast period. The emerging economies are expected to contribute to the growth of the market in the near future. Emerging economies such as China, India, and others are significantly contributing to the growth of the medical tapes and bandages market

Company Profiles and Competitive Intelligence:

The major players operating in the global medical malpractice insurance market are Chubb (ACE) (US), Hiscox Inc. (US), Allianz (Germany), Tokio Marine Holdings (Japan), XL Group (US), AXA (France), Travelers (US), Assicurazioni Generali (Italy), Doctors Company (US), Marsh & McLennan (US).

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

TABLE OF CONTENT

Chapter 1 Executive Summary

1.1. Market Summary

1.1.1. Global Medical Malpractice Insurance Market, 2016-2026, (US$ Million)

1.2. Market Snapshot: Global Medical Malpractice Insurance Market

1.3. Market Dynamics

1.4. Global Medical Malpractice Insurance Market, by Segment, 2018

1.4.1. Global Medical Malpractice Insurance Market, by Type, 2018, (US$ Million)

1.4.2. Global Medical Malpractice Insurance Market, by Coverage, 2018, (US$ Million)

1.4.3. Global Medical Malpractice Insurance Market, by Region, 2018 (US$ Million)

1.5. Premium Insights

1.5.1. Medical Malpractice Insurance Market in Developed Vs. Developing Economies, 2018 vs 2026

1.5.2. Global Medical Malpractice Insurance Market: Regional Life Cycle Analysis

Chapter 2 Market Dynamics

2.1. Market Overview

2.2. Market Drivers

2.2.1. Increasing prevalence of chronic diseases across the globe

2.2.2. Growing cases of medical Malpractice

2.2.3. Supportive government policies for medical insurance

2.3. Market Restraints

2.3.1. Concerns related policy wording and coverage availability

2.4. Market Opportunities

2.4.1. Substantial opportunities sin emerging market

2.5. Industry Value Chain Analysis

2.6. Pricing Analysis

2.7. Porter’s Five Forces Analysis

Chapter 3 Global Medical Malpractice Insurance Market, by Type

3.1. Market Overview, by Type

3.1.1. Global Medical Malpractice Insurance Market, by Type, 2016-2026 (US$ Million)

3.1.2. Incremental Opportunity, by Type, 2018

3.2. D&O Insurance

3.2.1. Global Medical Malpractice Insurance Market, by D&O Insurance, 2016-2026, (US$ Million)

3.3. E&O Insurance

3.3.1. Global Medical Malpractice Insurance Market, by E&O Insurance, 2016-2026, (US$ Million)

Chapter 4 Global Medical Malpractice Insurance Market, by Coverage

4.1. Market Overview, by Coverage

4.1.1. Global Medical Malpractice Insurance Market, by Coverage, 2016-2026 (US$ Million)

4.1.2. Incremental Opportunity, by Coverage, 2018

4.2. Up to US$1 Million

4.2.1. Global Medical Malpractice Insurance Market, by Up to US$1 Million, 2016-2026, (US$ Million)

4.3. US$1 Million to US$5 Million

4.3.1. Global Medical Malpractice Insurance Market, by US$1 Million to US$5 Million, 2016-2026, (US$ Million)

4.4. US$5 Million to US$20 Million

4.4.1. Global Medical Malpractice Insurance Market, by US$5 Million to US$20 Million, 2016-2026, (US$ Million)

4.5. Above $20 Million

4.5.1. Global Medical Malpractice Insurance Market, by Above US$20 Million, 2016-2026, (US$ Million)

Chapter 5 Global Medical Malpractice Insurance Market, by Region

5.1. Market Overview, by Region

5.1.1. Global Medical Malpractice Insurance Market, by Region, 2016-2026, (US$ Million)

5.2. Attractive Investment Opportunity, by Region, 2018

5.3. North America Medical Malpractice Insurance Market

5.3.1. North America Medical Malpractice Insurance Market, by Type, 2016-2026 (US$ Million)

5.3.2. North America Medical Malpractice Insurance Market, by Coverage, 2016-2026 (US$ Million)

5.3.3. United States Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.3.4. Canada Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.4. Europe Medical Malpractice Insurance Market

5.4.1. Europe Medical Malpractice Insurance Market, by Type, 2016-2026 (US$ Million)

5.4.2. Europe Medical Malpractice Insurance Market, by Coverage, 2016-2026 (US$ Million)

5.4.3. United Kingdom Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.4.4. Germany Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.4.5. France Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.4.6. Rest of Europe Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.5. Asia Pacific Medical Malpractice Insurance Market

5.5.1. Asia Pacific Medical Malpractice Insurance Market, by Type, 2016-2026 (US$ Million)

5.5.2. Asia Pacific Medical Malpractice Insurance Market, by Coverage, 2016-2026 (US$ Million)

5.5.3. China Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.5.4. Japan Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.5.5. India Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.5.6. Rest of Asia Pacific Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.6. Latin America Medical Malpractice Insurance Market

5.6.1. Latin America Medical Malpractice Insurance Market, by Type, 2016-2026 (US$ Million)

5.6.2. Latin America Medical Malpractice Insurance Market, by Coverage, 2016-2026 (US$ Million)

5.6.3. Brazil Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.6.4. Mexico Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.6.5. Rest of Latin America Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.7. Middle East & Africa Medical Malpractice Insurance Market

5.7.1. Middle East & Africa Medical Malpractice Insurance Market, by Type, 2016-2026 (US$ Million)

5.7.2. Middle East & Africa Medical Malpractice Insurance Market, by Coverage, 2016-2026 (US$ Million)

5.7.3. GCC Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

5.7.4. Rest of Middle East & Africa Medical Malpractice Insurance Market, 2016-2026 (US$ Million)

Chapter 6 Competitive Intelligence

6.1. Top 5 Players Comparison

6.2. Market Positioning of Key Players, 2018

6.3. Market Players Mapping

6.3.1. By Type

6.3.2. By Coverage

6.3.3. By Region

6.4. Strategies Adopted by Key Market Players

6.5. Recent Developments in the Market

6.5.1. Mergers & Acquisitions, Partnership, New Product Developments

Chapter 7 Company Profiles

7.1. Chubb (ACE)

7.1.1. Chubb (ACE) Overview

7.1.2. Chubb (ACE) Products Portfolio

7.1.3. Chubb (ACE) Financial Overview

7.1.4. Chubb (ACE) News/Recent Developments

7.2. Hiscox Inc.

7.2.1. Hiscox Inc. Overview

7.2.2. Hiscox Inc. Products Portfolio

7.2.3. Hiscox Inc. Financial Overview

7.2.4. Hiscox Inc. News/Recent Developments

7.3. Allianz

7.3.1. Allianz Overview

7.3.2. Allianz Products Portfolio

7.3.3. Allianz Financial Overview

7.3.4. Allianz News/Recent Developments

7.4. Tokio Marine Holdings

7.4.1. Tokio Marine Holdings Overview

7.4.2. Tokio Marine Holdings Products Portfolio

7.4.3. Tokio Marine Holdings Financial Overview

7.4.4. Tokio Marine Holdings News/Recent Developments

7.5. XL Group

7.5.1. XL Group Overview

7.5.2. XL Group Products Portfolio

7.5.3. XL Group Financial Overview

7.5.4. XL Group News/Recent Developments

7.6. AXA

7.6.1. AXA Overview

7.6.2. AXA Products Portfolio

7.6.3. AXA Financial Overview

7.6.4. AXA News/Recent Developments

7.7. Travelers

7.7.1. Travelers Overview

7.7.2. Travelers Products Portfolio

7.7.3. Travelers Financial Overview

7.7.4. Travelers News/Recent Developments

7.8. Assicurazioni Generali

7.8.1. Assicurazioni Generali Overview

7.8.2. Assicurazioni Generali Products Portfolio

7.8.3. Assicurazioni Generali Financial Overview

7.8.4. Assicurazioni Generali News/Recent Developments

7.9. Doctors Company

7.9.1. Doctors Company Overview

7.9.2. Doctors Company Products Portfolio

7.9.3. Doctors Company Financial Overview

7.9.4. Doctors Company News/Recent Developments

7.10. Marsh & McLennan

7.10.1. Marsh & McLennan Overview

7.10.2. Marsh & McLennan Products Portfolio

7.10.3. Marsh & McLennan Financial Overview

7.10.4. Marsh & McLennan News/Recent Developments

Chapter 8 Preface

8.1. Data Triangulation

8.2. Research Methodology

8.2.1. Coverage I – Secondary Research

8.2.2. Coverage II – Primary Research

8.2.3. Coverage III – Expert Panel Review

8.2.4. Approach Adopted

8.2.4.1. Top-Down Approach

8.2.4.2. Bottom-Up Approach

8.2.5. Supply- Demand side

8.2.6. Breakup of the Primary Profiles