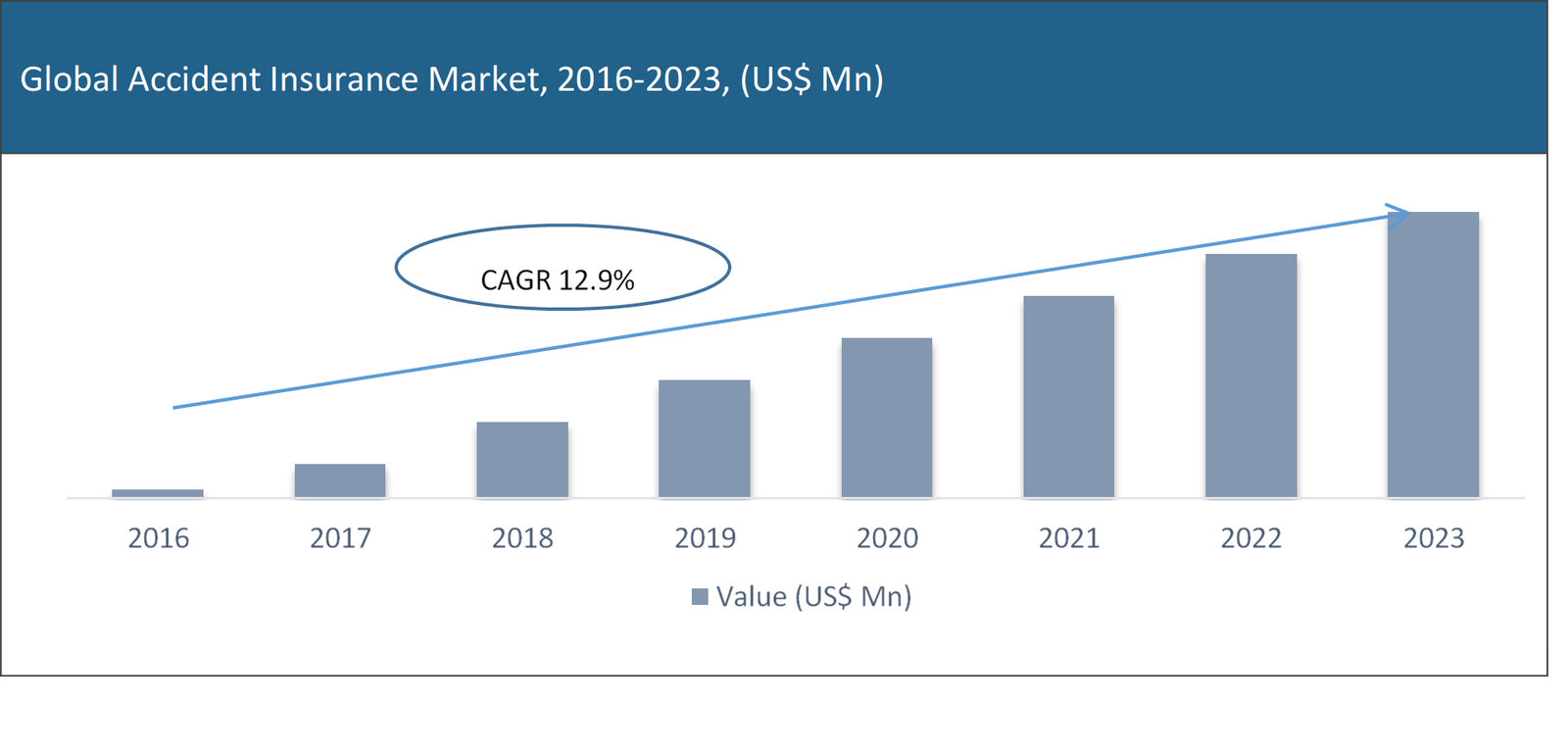

Global Accident Insurance Market expected to grow at a CAGR of 12.9% from 2018 to 2023. Accident insurance is a type of financial product that provides benefits to the beneficiary if the cause of his/her injuries is an accident. This type of accident insurance benefits is added to some life insurance policies. The accident insurance coverage pays for injuries, initial care, treatment, facility care and follow-up care.

Based on types, the death & dismemberment segment is growing at the fastest pace. The accidental death and dismemberment insurance pays benefits to the concerned person if the cause of death is an accident. However, deaths caused by wars, suicides, old age, and illnesses are not covered in this type of insurance. Further, general accident insurance policies are limited to the events involving the death and dismemberment of the policyholder. This type of accidental insurance covers paralysis, loss of limbs, partial disabilities, and others.

In addition to these, disability insurance is the type of insurance provided in the workplace by employers. This type of insurance covers on-the-job accidents that prevent the worker from continuing the work. This insurance provides benefits to employees by paying them on a monthly or weekly basis, depending on the type of policy.

Based on applications, the enterprise segment is growing at the fastest pace during the forecast period. The increasing use of accident insurance by enterprises is driving the growth of Accident Insurance market. Employers offer insurance benefits to workers in order to acquire talented employees and avoid penalties. Enterprises also provide accidental insurance to their employees in order to ensure their wellness.

Based on region for Accident Insurance market, North America is growing at the fastest pace owing to an increase in awareness about accident insurance policies in the region. The region is followed by the Asia-Pacific region, owing to an increase in disposable income in the region.

By Type:

By Application

Regions Covered in Accident Insurance Market Report are:

North America

Europe

Asia Pacific

LATAM

Middle East Africa

Key Players Covered in Accident Insurance Market Report are:

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Accident Insurance Market, 2016-2023, (US$ Mn)

2.1 Market Snapshot: Global Accident Insurance Market

2.2 Market Dynamics

2.3 Global Accident Insurance Market, by Segment, 2018

2.3.1 Global Accident Insurance Market, by Type, 2018, (US$ Mn)

2.3.2 Global Accident Insurance Market, by Application, 2018 (US$ Mn)

2.3.3 Global Accident Insurance Market, by Region, 2018 (US$ Mn)

2.4 Premium Insights

2.4.1 Accident Insurance Market In Developed Vs. Developing Economies, 2018 vs 2023

2.4.2 Global Accident Insurance Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Increasing number of accidents

3.2.2 Rise in government initiatives

3.2.3 Driver 3

3.3 Market Restraints

3.3.1 Lack of awareness

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Growing adoption of accident insurance by enterprise

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Accident Insurance Market, by Type

4.1 Market Overview, by Type

4.1.1 Global Accident Insurance Market, by Type, 2016-2023 (US$ Mn)

4.1.2 Incremental Opportunity, by Type, From 2018-2023

4.2 Death and Dismemberment Insurance

4.2.1 Global Accident Insurance Market, by Death and Dismemberment Insurance, 2016-2023, (US$ Mn)

4.3 General Accident Insurance

4.3.1 Global Accident Insurance Market, by General Accident Insurance, 2016-2023, (US$ Mn)

4.4 Disabilities Insurance

4.4.1 Global Accident Insurance Market, by Disabilities Insurance, 2016-2023, (US$ Mn)

Chapter 5 Global Accident Insurance Market, by Application

5.1 Market Overview, by Application

5.1.1 Global Accident Insurance Market, by Application, 2016-2023 (US$ Mn)

5.1.2 Incremental Opportunity, by Application, From 2018-2023

5.2 Enterprise

5.2.1 Global Accident Insurance Market, by Enterprise, 2016-2023, (US$ Mn)

5.3 Personal

5.3.1 Global Accident Insurance Market, by Personal, 2016-2023, (US$ Mn)

Chapter 6 Global Accident Insurance Market, by Region

6.1 Market Overview, by Region

6.1.1 Global Accident Insurance Market, by Region, 2016-2023, (US$ Mn)

6.2 Attractive Investment Opportunity, by Region, 2018

6.3 North America Accident Insurance Market

6.3.1 North America Accident Insurance Market, by Type, 2016-2023 (US$ Mn)

6.3.2 North America Accident Insurance Market, by Application, 2016-2023 (US$ Mn)

6.3.3 United States Country Profile

6.3.3.1 United States Accident Insurance Market, 2016-2023 (US$ Mn)

6.3.4 Canada Country Profile

6.3.4.1 Canada Accident Insurance Market, 2016-2023 (US$ Mn)

6.3.5 Mexico Country Profile

6.3.5.1 Mexico Accident Insurance Market, 2016-2023 (US$ Mn)

6.4 Europe Accident Insurance Market

6.4.1 Europe Accident Insurance Market, by Type, 2016-2023 (US$ Mn)

6.4.2 Europe Accident Insurance Market, by Application, 2016-2023 (US$ Mn)

6.4.3 United Kingdom Country Profile

6.4.3.1 United Kingdom Accident Insurance Market, 2016-2023 (US$ Mn)

6.4.4 Germany Country Profile

6.4.4.1 Germany Accident Insurance Market, 2016-2023 (US$ Mn)

6.4.5 France Country Profile

6.4.5.1 France Accident Insurance Market, 2016-2023 (US$ Mn)

6.4.6 Italy Country Profile

6.4.6.1 Italy Accident Insurance Market, 2016-2023 (US$ Mn)

6.4.7 Spain Country Profile

6.4.7.1 Spain Accident Insurance Market, 2016-2023 (US$ Mn)

6.4.8 Rest of Europe

6.4.8.1 Rest of Europe Accident Insurance Market, 2016-2023 (US$ Mn)

6.5 Asia Pacific Accident Insurance Market

6.5.1 Asia Pacific Accident Insurance Market, by Type, 2016-2023 (US$ Mn)

6.5.2 Asia Pacific Accident Insurance Market, by Application, 2016-2023 (US$ Mn)

6.5.3 China Country Profile

6.5.3.1 China Accident Insurance Market, 2016-2023 (US$ Mn)

6.5.4 Japan Country Profile

6.5.4.1 Japan Accident Insurance Market, 2016-2023 (US$ Mn)

6.5.5 India Country Profile

6.5.5.1 India Accident Insurance Market, 2016-2023 (US$ Mn)

6.5.6 South Korea Country Profile

6.5.6.1 South Korea Accident Insurance Market, 2016-2023 (US$ Mn)

6.5.7 Southeast Asia Country Profile

6.5.7.1 Southeast Asia Accident Insurance Market, 2016-2023 (US$ Mn)

6.5.8 Rest of Asia Pacific

6.5.8.1 Rest of Asia Pacific Accident Insurance Market, 2016-2023 (US$ Mn)

6.6 Latin America Accident Insurance Market

6.6.1 Latin America Accident Insurance Market, by Type, 2016-2023 (US$ Mn)

6.6.2 Latin America Accident Insurance Market, by Application, 2016-2023 (US$ Mn)

6.6.3 Brazil Country Profile

6.6.3.1 Brazil Accident Insurance Market, 2016-2023 (US$ Mn)

6.6.4 Argentina Country Profile

6.6.4.1 Argentina Accident Insurance Market, 2016-2023 (US$ Mn)

6.6.5 Rest of Latin America

6.6.5.1 Rest of Latin America Accident Insurance Market, 2016-2023 (US$ Mn)

6.7 Middle East & Africa Accident Insurance Market

6.7.1 Middle East & Africa Accident Insurance Market, by Type, 2016-2023 (US$ Mn)

6.7.2 Middle East & Africa Accident Insurance Market, by Application, 2016-2023 (US$ Mn)

6.7.3 South Africa

6.7.3.1 South Africa Accident Insurance Market, 2016-2023 (US$ Mn)

6.7.4 GCC

6.7.4.1 GCC Accident Insurance Market, 2016-2023 (US$ Mn)

6.7.5 Rest of Middle East & Africa

6.7.5.1 Rest of Middle East & Africa Accident Insurance Market, 2016-2023 (US$ Mn)

Chapter 7 Competitive Intelligence

7.1 Market Players Present in Market Life Cycle

7.2 Top 5 Players Comparison

7.3 Market Positioning of Key Players, 2018

7.4 Market Players Mapping

7.4.1 By Type

7.4.2 By Application

7.4.3 By Region

7.5 Strategies Adopted by Key Market Players

7.6 Recent Developments in the Market

7.6.1 Mergers & Acquisitions, Partnership, New Product Developments

7.7 Operational Efficiency Comparison by Key Players

Chapter 8 Company Profiles

8.1 Dai-ichi Mutual Life Insurance

8.1.1 Dai-ichi Mutual Life Insurance Overview

8.1.2 Key Stakeholders/Person in Dai-ichi Mutual Life Insurance

8.1.3 Dai-ichi Mutual Life Insurance Products Portfolio

8.1.4 Dai-ichi Mutual Life Insurance Financial Overview

8.1.5 Dai-ichi Mutual Life Insurance News/Recent Developments

8.2 MetLife Inc.

8.2.1 MetLife Inc. Overview

8.2.2 Key Stakeholders/Person in MetLife Inc.

8.2.3 MetLife Inc. Products Portfolio

8.2.4 MetLife Inc. Financial Overview

8.2.5 MetLife Inc. News/Recent Developments

8.3 PingAn Insurance

8.3.1 PingAn Insurance Overview

8.3.2 Key Stakeholders/Person in PingAn Insurance

8.3.3 PingAn Insurance Products Portfolio

8.3.4 PingAn Insurance Financial Overview

8.3.5 PingAn Insurance News/Recent Developments

8.4 Zurich Financial Services

8.4.1 Zurich Financial Services Overview

8.4.2 Key Stakeholders/Person in Zurich Financial Services

8.4.3 Zurich Financial Services Products Portfolio

8.4.4 Zurich Financial Services Financial Overview

8.4.5 Zurich Financial Services News/Recent Developments

8.5 Allianz SE

8.5.1 Allianz SE Overview

8.5.2 Key Stakeholders/Person in Allianz SE

8.5.3 Allianz SE Products Portfolio

8.5.4 Allianz SE Financial Overview

8.5.5 Allianz SE News/Recent Developments

8.6 Sumitomo Life Insurance

8.6.1 Sumitomo Life Insurance Overview

8.6.2 Key Stakeholders/Person in Sumitomo Life Insurance

8.6.3 Sumitomo Life Insurance Products Portfolio

8.6.4 Sumitomo Life Insurance Financial Overview

8.6.5 Sumitomo Life Insurance News/Recent Developments

8.7 China Life Insurance

8.7.1 China Life Insurance Overview

8.7.2 Key Stakeholders/Person in China Life Insurance

8.7.3 China Life Insurance Products Portfolio

8.7.4 China Life Insurance Financial Overview

8.7.5 China Life Insurance News/Recent Developments

8.8 Aegon N.V.

8.8.1 Aegon N.V. Overview

8.8.2 Key Stakeholders/Person in Aegon N.V.

8.8.3 Aegon N.V. Products Portfolio

8.8.4 Aegon N.V. Financial Overview

8.8.5 Aegon N.V. News/Recent Developments

8.9 Aviva plc

8.9.1 Aviva plc Overview

8.9.2 Key Stakeholders/Person in Aviva plc

8.9.3 Aviva plc Products Portfolio

8.9.4 Aviva plc Financial Overview

8.9.5 Aviva plc News/Recent Developments

8.10 Munich Re Group

8.10.1 Munich Re Group Overview

8.10.2 Key Stakeholders/Person in Munich Re Group

8.10.3 Munich Re Group Products Portfolio

8.10.4 Munich Re Group Financial Overview

8.10.5 Munich Re Group News/Recent Developments