The U.S. compounding pharmacies market was valued at USD 4,624.4 Mn in 2018 and is expected to reach USD 6,943.4 Mn by the year 2026, growing at a CAGR of 5.2% during the forecast period. Compounding is the process of creating personalized medicine for specific patients. This allows a physician to prescribe a very specific medication, prepared by a pharmacist, for a patient’s individual needs.

U.S. compounding pharmacies market is witnessing growth due to the increasing demand of personalized medications and the convenience of using compounded drugs. According to the IACP, there are 56,000 community-based pharmacies in the U.S. About half of them directly serve local patients and doctors. Some 7,500 compounding pharmacies specialize in what the IACP calls "advanced compounding services." Some 3,000 of these pharmacies make sterile products. The tainted steroid shots made by NECC were supposed to have been sterile.

U.S. Compounding Pharmacies Market Segmentation |

|

|

By Product Type |

|

|

By Compounding Type |

|

|

By Application |

|

|

By Sterility |

|

|

By Pharmacy Type |

|

|

By Therapeutic Area |

|

FDA’s compounding program aims to protect patients from unsafe, ineffective, and poor-quality compounded drugs, while preserving access to lawfully marketed compounded drugs for patients who have a medical need for them. However, lack of skilled lab technicians and pharmacists and stringent policies & norms by FDA.

The oral medications segment dominated the U.S. compounding pharmacies market in the year 2018

The oral medications segment dominated the market in 2018 with a share of 39.6% and is expected to account a share of 33.5% in 2026. High demand for easy to administer dosage forms such as capsules, oral liquids and granules will drive the growth of the segment.

Growing healthcare awareness and oral medication being the most preferred route of administration is projected to fuel demand for oral medications over the forecast period. Patients suffering from severe gastroesophageal reflux disease (GERD) makes the use of oral nonsteroidal anti-inflammatory drugs (NSAIDs) less desirable. The market for oral medications is growing at a lucrative rate, however, patent expiration & stiff competition from generic brands is giving a tough competition to its growth.

The pharmaceutical ingredient alteration segment dominated the U.S. compounding pharmacies market in the year 2018

The pharmaceutical ingredient alteration segment is anticipated to grow with the highest CAGR of 5.9% over the forecast period, followed by Pharmaceutical Ingredient Alteration (5.8%), Currently Unavailable Pharmaceutical Manufacturing (5.4%) and Others (4.0%).

Pharmaceutical ingredient alteration is done in order to meet the requirements of the patients. In some cases, some patients are allergic to a preservative or dye in a manufactured product for which compounding pharmacists can prepare a dye-free or preservative-free dosage form. To satisfy a specific patient need and ensure patient adherence, doctors prescribe a commercially available drug in a different dosage form. Most pediatric patients are nonadherent because their medications are salty, but when the medicine is flavored to their taste, they start taking medications as per the prescription.

The major players operating in U.S. compounding pharmacies market are Central Admixture Pharmacy Services, Fagron NV, Advanced Pharma (Avella Specialty Pharmacy), SCA Pharma, KRS Global Biotechnology Inc., Fresenius Kabi Global, PharMEDium Services, LLC, Cantrell Drug Company, Clinigen Group, Smith Caldwell Drug Store and amongst others.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Chapter 1 Preface

1.1 Report Description

1.1.1 Application of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

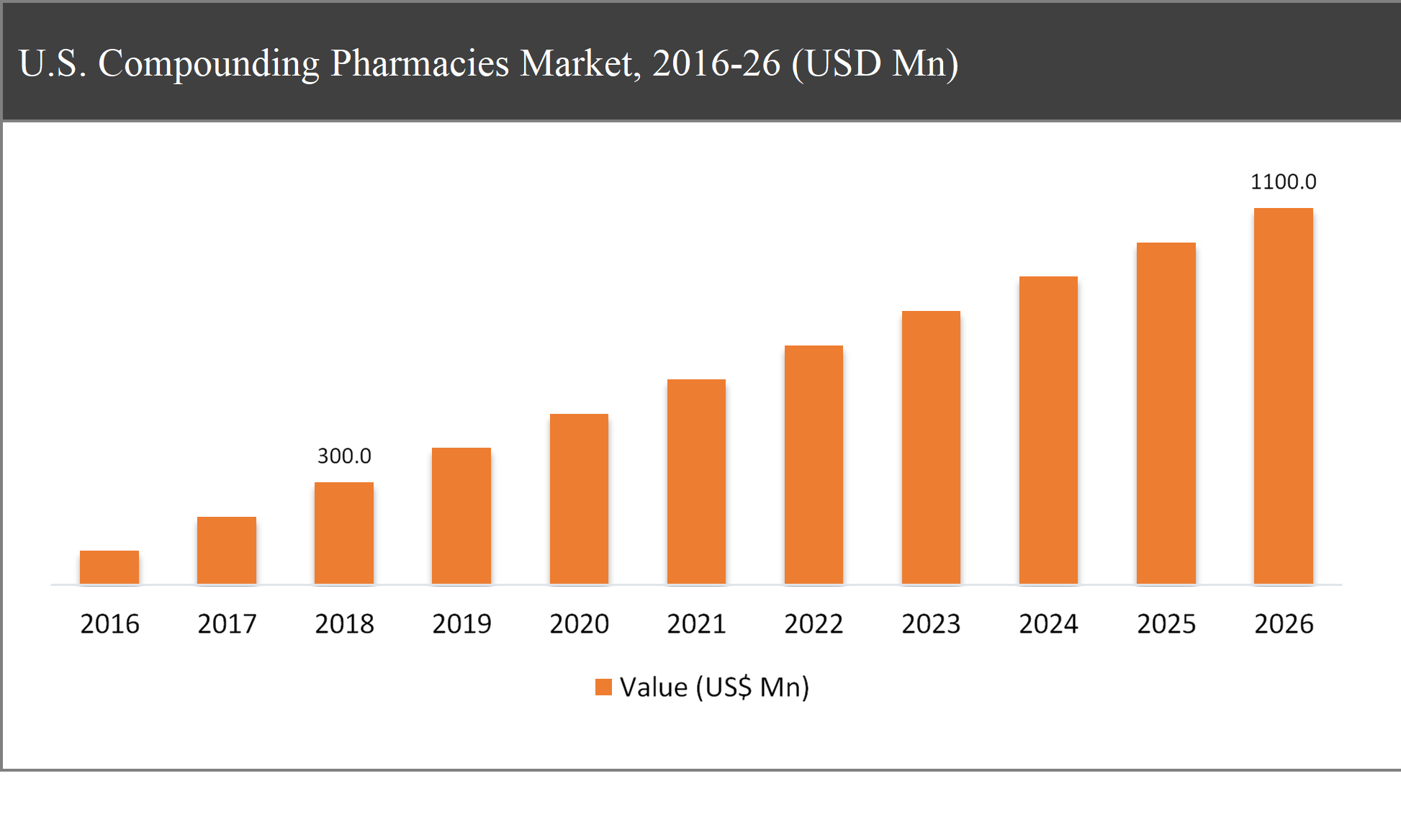

2.1.1 U.S. Compounding Pharmacies Market, 2016-2026, (US$ Mn)

2.1 Market Snapshot: U.S. Compounding Pharmacies Market

2.2 Market Dynamics

2.3 U.S. Compounding Pharmacies Market, by Segment, 2018

2.3.1 U.S. Compounding Pharmacies Market, by Product Type, 2018, (US$ Mn)

2.3.2 U.S. Compounding Pharmacies Market, by Compounding Type, 2018,(US$ Mn)

2.3.3 U.S. Compounding Pharmacies Market, by Application, 2018 (US$ Mn)

2.3.4 U.S. Compounding Pharmacies Market, by Sterility, 2018 (US$ Mn)

2.3.5 U.S. Compounding Pharmacies Market, by Pharmacy Type, 2018 (US$ Mn)

2.3.6 U.S. Compounding Pharmacies Market, by Therapeutic Area, 2018 (US$ Mn)

2.4 Premium Insights

2.4.1 Regulations and Guidelines for Compounding Pharmacies/Enforcement

2.4.2 Major Trends & Impacts, by Compounding Type

2.4.3 Major aspects considered for Compounding a Prescription

2.4.4 Key considerations for Batch Compounding

2.4.5 Reimbursement scenario and denial of coverage

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Growing acceptance of personalized medicines in U.S.

3.2.2 Convenience of using compounded drugs

3.2.3 Increase geriatric population & longevity globally

3.3 Market Restraints

3.3.1 Lack of skilled lab technicians and pharmacists

3.3.2 High costs of equipment and maintenance of sterile environment

3.1 Major Trends and Impact on Growth Trajectory

Chapter 4 U.S. Compounding Pharmacies Market, by Product Type

4.1 Market Overview, by Product Type

4.1.1 U.S. Compounding Pharmacies Market, by Product Type, 2016-2026 (US$ Mn)

4.1.2 Incremental Opportunity, by Product Type, From 2018-2026

4.2 Oral Medication

4.2.1 U.S. Compounding Pharmacies Market, by Oral Medication , 2016-2026, (US$ Mn)

4.3 Topical Medication

4.3.1 U.S. Compounding Pharmacies Market, by Topical Medication, 2016-2026, (US$ Mn)

4.4 Mouthwashes

4.4.1 U.S. Compounding Pharmacies Market, by Mouthwashes, 2016-2026, (US$ Mn)

4.5 Suppositories

4.5.1 U.S. Compounding Pharmacies Market, by Suppositories, 2016-2026, (US$ Mn)

4.6 Injectables

4.6.1 U.S. Compounding Pharmacies Market, by Injectables, 2016-2026, (US$ Mn)

Chapter 5 U.S. Compounding Pharmacies Market, by Compounding Type

5.1 Market Overview, by Compounding Type

5.1.1 U.S. Compounding Pharmacies Market, by Compounding Type, 2016-2026 (US$ Mn)

5.1.2 Incremental Opportunity, by Compounding Type, From 2018-2026

5.2 PIA

5.2.1 U.S. Compounding Pharmacies Market, by PIA, 2016-2026, (US$ Mn)

5.3 CUPM

5.3.1 U.S. Compounding Pharmacies Market, by CUPM, 2016-2026, (US$ Mn)

5.4 PDA

5.4.1 U.S. Compounding Pharmacies Market, by PDA, 2016-2026, (US$ Mn)

5.5 Others

5.5.1 U.S. Compounding Pharmacies Market, by Others, 2016-2026, (US$ Mn)

Chapter 6 U.S. Compounding Pharmacies Market, by Application

6.1 Market Overview, by Application

6.1.1 U.S. Compounding Pharmacies Market, by Application, 2016-2026 (US$ Mn)

6.1.2 Incremental Opportunity, by Application, From 2018-2026

6.2 Pediatric

6.2.1 U.S. Compounding Pharmacies Market, by Pediatric, 2016-2026, (US$ Mn)

6.3 Adult

6.3.1 U.S. Compounding Pharmacies Market, by Adult, 2016-2026, (US$ Mn)

6.4 Geriatric

6.4.1 U.S. Compounding Pharmacies Market, by Geriatric, 2016-2026, (US$ Mn)

6.5 Veterinary

6.5.1 U.S. Compounding Pharmacies Market, by Veterinary, 2016-2026, (US$ Mn)

Chapter 7 U.S. Compounding Pharmacies Market, by Sterility

7.1 Market Overview, by Sterility

7.1.1 U.S. Compounding Pharmacies Market, by Sterility, 2016-2026 (US$ Mn)

7.1.2 Incremental Opportunity, by Sterility, From 2018-2026

7.2 Sterile

7.2.1 U.S. Compounding Pharmacies Market, by Sterile, 2016-2026, (US$ Mn)

7.3 Non-Sterile

7.3.1 U.S. Compounding Pharmacies Market, by Non-Sterile, 2016-2026, (US$ Mn)

Chapter 8 U.S. Compounding Pharmacies Market, by Pharmacy Type

8.1 Market Overview, by Pharmacy Type

8.1.1 U.S. Compounding Pharmacies Market, by Pharmacy Type, 2016-2026 (US$ Mn)

8.1.2 Incremental Opportunity, by Pharmacy Type, From 2018-2026

8.2 503A

8.2.1 U.S. Compounding Pharmacies Market, by 503A, 2016-2026, (US$ Mn)

8.3 503B

8.3.1 U.S. Compounding Pharmacies Market, by 503B, 2016-2026, (US$ Mn)

Chapter 9 U.S. Compounding Pharmacies Market, by Therapeutic Area

9.1 Market Overview, by Therapeutic Area

9.1.1 U.S. Compounding Pharmacies Market, by Therapeutic Area, 2016-2026 (US$ Mn)

9.1.2 Incremental Opportunity, by Therapeutic Area, From 2018-2026

9.2 Hormone Replacement Therapy

9.2.1 U.S. Compounding Pharmacies Market, by Hormone Replacement Therapy, 2016-2026, (US$ Mn)

9.3 Pain Management

9.3.1 U.S. Compounding Pharmacies Market, by Pain Management, 2016-2026, (US$ Mn)

9.4 Dermatology

9.4.1 U.S. Compounding Pharmacies Market, by Dermatology, 2016-2026, (US$ Mn)

9.5 Oncology

9.5.1 U.S. Compounding Pharmacies Market, by Oncology, 2016-2026, (US$ Mn)

9.6 Hematology

9.6.1 U.S. Compounding Pharmacies Market, by Hematology, 2016-2026, (US$ Mn)

9.7 Dental

9.7.1 U.S. Compounding Pharmacies Market, by Dental, 2016-2026, (US$ Mn)

9.8 Others

9.8.1 U.S. Compounding Pharmacies Market, by Others, 2016-2026, (US$ Mn)

Chapter 10 Competitive Intelligence

10.1 Market Players Present in Market Life Cycle

10.2 Top 5 Players Comparison

10.3 Market Positioning of Key Players, 2018

10.4 Market Players Mapping

10.4.1 By Product Type

10.4.2 By Application

10.4.1 By Sterility

10.4.2 By Pharmacy Type

10.4.3 By Therapeutic Area

10.5 Strategies Adopted by Key Market Players

10.6 Recent Developments in the Market

10.6.1 Mergers & Acquisitions, Partnership, New Product Developments

Chapter 11 Company Profiles

11.1 Central Admixture Pharmacy Services

11.1.1 Central Admixture Pharmacy Services Overview

11.1.2 Key Stakeholders/Person in Central Admixture Pharmacy Services

11.1.3 Central Admixture Pharmacy Services Products Portfolio

11.1.4 Central Admixture Pharmacy Services Financial Overview

11.1.5 Central Admixture Pharmacy Services News/Recent Developments

11.2 Fagron NV

11.2.1 Fagron NV Overview

11.2.2 Key Stakeholders/Person in Fagron NV

11.2.3 Fagron NV Products Portfolio

11.2.4 Fagron NV Financial Overview

11.2.5 Fagron NV News/Recent Developments

11.3 Advanced Pharma (Avella Specialty Pharmacy)

11.3.1 Advanced Pharma (Avella Specialty Pharmacy) Overview

11.3.2 Key Stakeholders/Person in Advanced Pharma (Avella Specialty Pharmacy)

11.3.3 Advanced Pharma (Avella Specialty Pharmacy) Products Portfolio

11.3.4 Advanced Pharma (Avella Specialty Pharmacy) Financial Overview

11.3.5 Advanced Pharma (Avella Specialty Pharmacy) News/Recent Developments

11.4 SCA Pharma

11.4.1 SCA Pharma Overview

11.4.2 Key Stakeholders/Person in SCA Pharma

11.4.3 SCA Pharma Products Portfolio

11.4.4 SCA Pharma Financial Overview

11.4.5 SCA Pharma News/Recent Developments

11.5 KRS Global Biotechnology Inc.

11.5.1 KRS Global Biotechnology Inc. Overview

11.5.2 Key Stakeholders/Person in KRS Global Biotechnology Inc.

11.5.3 KRS Global Biotechnology Inc. Products Portfolio

11.5.4 KRS Global Biotechnology Inc. Financial Overview

11.5.5 KRS Global Biotechnology Inc. News/Recent Developments

11.6 Fresenius Kabi Global

11.6.1 Fresenius Kabi Global Overview

11.6.2 Key Stakeholders/Person in Fresenius Kabi Global

11.6.3 Fresenius Kabi Global Products Portfolio

11.6.4 Fresenius Kabi Global Financial Overview

11.6.5 Fresenius Kabi Global News/Recent Developments

11.7 PharMEDium Services, LLC

11.7.1 PharMEDium Services, LLC Overview

11.7.2 Key Stakeholders/Person in PharMEDium Services, LLC

11.7.3 PharMEDium Services, LLC Products Portfolio

11.7.4 PharMEDium Services, LLC Financial Overview

11.7.5 PharMEDium Services, LLC News/Recent Developments

11.8 Cantrell Drug Company

11.8.1 Cantrell Drug Company Overview

11.8.2 Key Stakeholders/Person in Cantrell Drug Company

11.8.3 Cantrell Drug Company Products Portfolio

11.8.4 Cantrell Drug Company Financial Overview

11.8.5 Cantrell Drug Company News/Recent Developments

11.9 Clinigen Group

11.9.1 Clinigen Group Overview

11.9.2 Key Stakeholders/Person in Clinigen Group

11.9.3 Clinigen Group Products Portfolio

11.9.4 Clinigen Group Financial Overview

11.9.5 Clinigen Group News/Recent Developments

11.10 Smith Caldwell Drug Store

11.10.1 Smith Caldwell Drug Store Overview

11.10.2 Key Stakeholders/Person in Smith Caldwell Drug Store

11.10.3 Smith Caldwell Drug Store Products Portfolio

11.10.4 Smith Caldwell Drug Store Financial Overview

11.10.5 Smith Caldwell Drug Store News/Recent Developments