Active safety features are basically electronic and computer-controlled components used in modern vehicles and they offer both driver and passenger safety. The global automotive active safety market is experiencing significant growth owing to the rising concern about road safety.

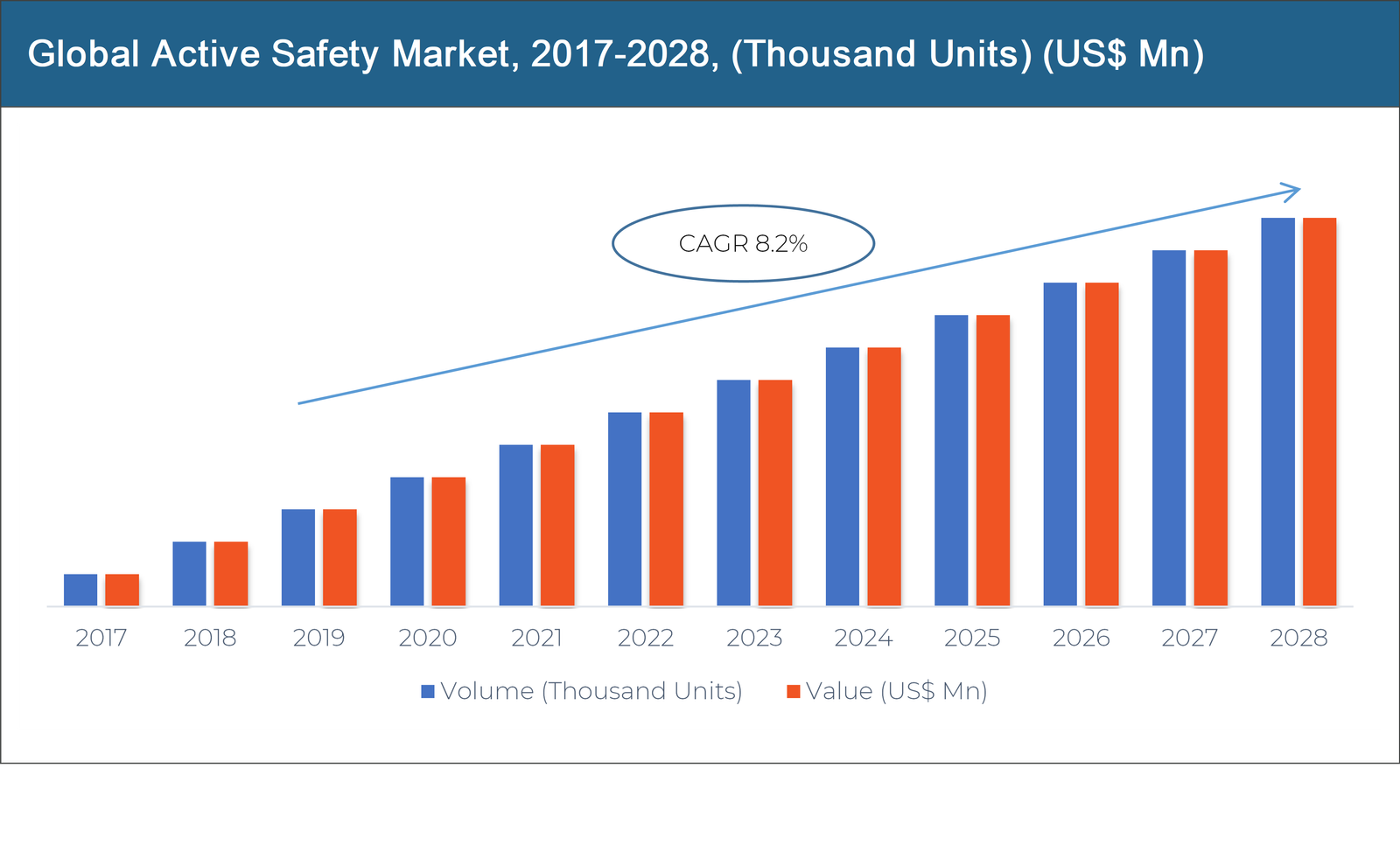

The automotive active safety market report provides an analysis for the period from 2017 to 2028, where 2019 to 2028 is the forecast period, while 2018 is the base year. This report on automotive active safety covers an in-depth analysis of the market including statistical and subjective data points, along with the key market drivers and opportunities & restraints that have positive or negative effects on the overall global market.

An exclusive coverage has been provided for market drivers and challenges & opportunities for a country-level market in the respective regional segments. The report comprises a competitive analysis of the key players functioning in the market and covers in-depth data related to the competitive landscape of the market and recent strategies & products that will assist or affect the market in the coming years.

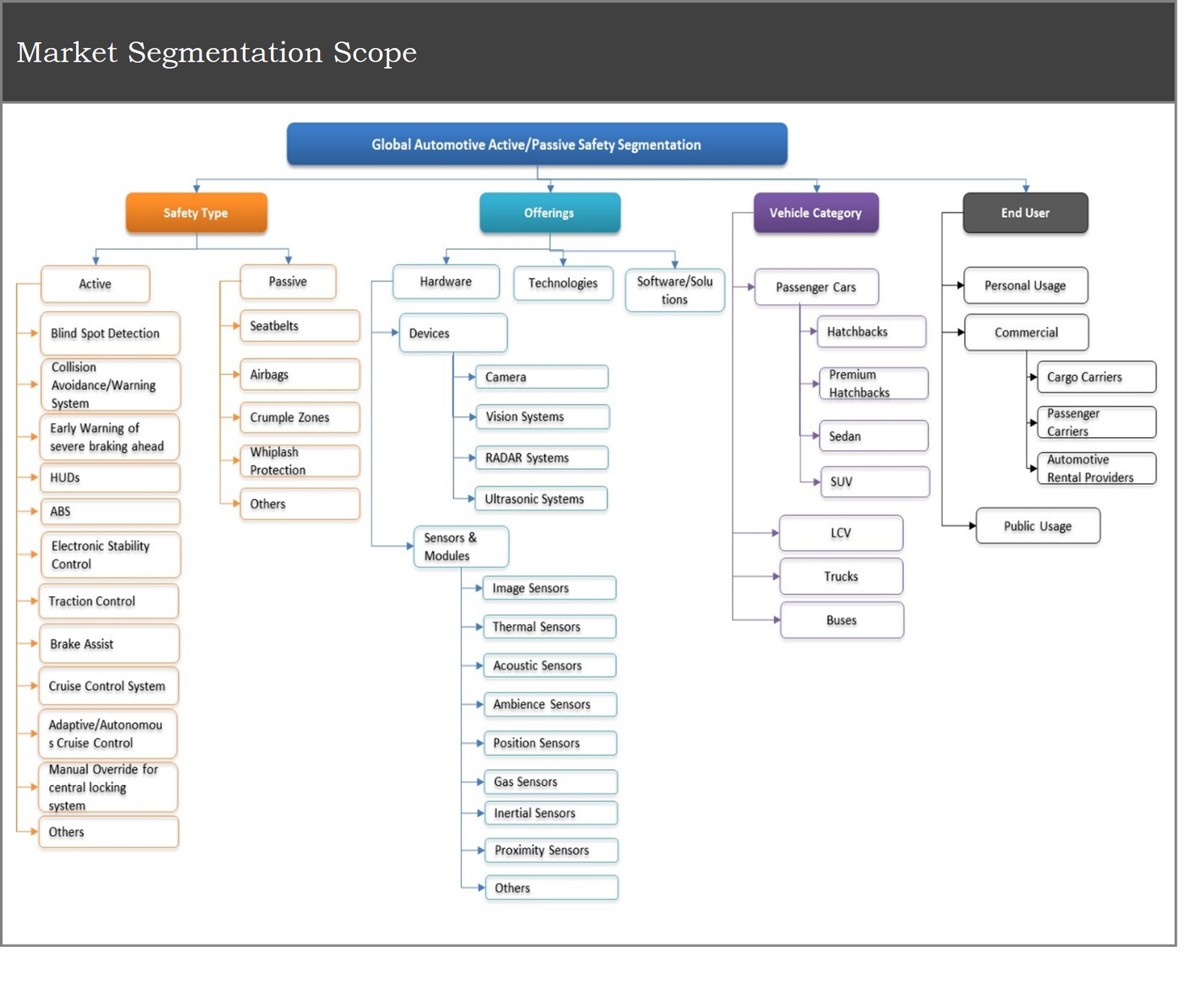

The global automotive active safety market has been segmented on the basis of different safety types, such as blind spot detection, collision avoidance/warning systems, early warning of severe braking ahead, HUDs, ABS, electronic stability control, traction control, brake assist, adaptive/ autonomous cruise control, and manual override for central locking, among others. By different vehicle category, the market has been segmented into passenger cars, light commercial vehicles, trucks, and buses. The passenger vehicle segment has been further segmented into hatchback, premium hatchback, SUVs, and sedans.

By different offerings, the active safety market is segmented into hardware, technologies, and software solutions. On the basis of different hardware, the market has been segmented into devices, sensors, and modules. On the basis of different devices, the market has been segmented into camera, vision system, radar system, and ultrasonic system. By different sensors and modules, the market has been segmented into image sensors, thermal sensors, acoustic sensors, ambience sensors, position sensors, gas sensors, inertial sensors, proximity sensors, and others. On the basis of different end-users, the market has been segmented into personal usage, commercial, and public usage. The commercial segment has been segmented into cargo carriers, passenger carriers, and automotive rental providers.

The ABS segment dominated the market in 2018 and is expected to display a similar trend in the coming years

In terms of safety type, the ABS segment dominated the market in 2018. ABS prevents the wheel from locking up, thus helping to avoid uncontrolled skidding of vehicles. It also decreases the distance travelled without slipping. ABS generally offers improved vehicle control and decreases stopping distances on slippery and dry surfaces. The current government regulations have mandated ABS across several countries such as the U.S, Germany, and India, among others, thereby boosting the overall market growth over the years.

The increasing number of passenger vehicles across the globe is also a major factor to cause a rise in the demand for ABS. In addition to this, increasing rates of accidents are also triggering the overall market growth of active safety.

The Passenger car segment dominated the market in 2018 and is expected to display a similar trend in the coming years

In terms of different vehicle category, the passenger car segment accounted for a majority of market share in 2018. In 2017, there were production of 73.45 million units of passenger vehicles across the globe. China, Japan, and Germany are the major countries that are producing passenger vehicles in 2018. This has resulted in the rise in demand for active safety features in passenger vehicles in recent years.

The passenger vehicle segment is further segregated into hatchbacks, premium hatchbacks, SUVs, and sedans. Hatchbacks dominated the market owing to its affordability, low maintenance cost compared to sedans and SUVs. However, sedans and SUVs are expected to witness significant growth during the forecast period, owing to increasing safety features in these cars.

Region

North America

Europe

Asia Pacific

LATAM

Middle East Africa (MEA)

Asia Pacific is expected to witness the fastest growth during the forecast period

In terms of different region Asia Pacific market is expected to witness the fastest growth during the forecast period. India and China are leading economies in the Asia-Pacific region, owing to the rising awareness towards safety features in vehicles, increasing per capita income, and significant investments by top industry players due to potential growth opportunities present in the region.

The key players in the global automotive active safety market are Autoliv Inc., Veoneer, Robert Bosch GmbH, Continental AG, Delphi Automotive LLP, TRW automotive, and Denso Corporation, among others. The players have stepped up to adopt new marketing strategies in order to spread awareness regarding safety features in vehicles. Moreover, market growth is attributed to strategic mergers & acquisitions, geographical expansions, and joint ventures & partnerships, which help to ensure long-term sustenance in the market.

Key Questions Answered in the Report:

• What is the market value and volume of the overall automotive active safety market?

• What are the different segments and sub-segments in the market?

• What are the key drivers, restraints, opportunities, and challenges in the market and how are they expected to impact the market?

• What are the attractive segments and geographies to invest in?

• What is the market value and volume at the regional and the country level?

• Who are the key market players and their key competitors?

• What are the different strategies adopted by the key players in the market?

• How does a particular company rank against its competitors with respect to revenue, profit comparison, operational efficiency, cost competitiveness, and market capitalization?

• How financially strong are the key players in the market (on the basis of revenue and profit margin, market capitalization, expenditure analysis, investment analysis)?

• What are the recent trends in the market? (M&A, partnerships, new product developments, expansions)

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Table of Content

Chapter 1 Preface

1.1 Report Description

1.1.1 Purpose of the Report

1.1.2 Target Audience

1.1.3 USP and Key Offerings

1.2 Research Scope

1.3 Research Methodology

1.3.1 Phase I – Secondary Research

1.3.2 Phase II – Primary Research

1.3.3 Phase III – Expert Panel Review

1.3.4 Approach Adopted

1.3.4.1 Top-Down Approach

1.3.4.2 Bottom-Up Approach

1.3.5 Assumptions

1.4 Market Segmentation Scope

Chapter 2 Executive Summary

2.1 Market Summary

2.1.1 Global Active Safety Market, 2017-2028, (Thousand Units) (US$ Mn)

2.1 Market Snapshot: Global Active Safety Market

2.2 Market Dynamics

2.3 Global Active Safety Market, by Segment, 2018

2.3.1 Global Active Safety Market, by Type, 2018, (Thousand Units) (US$ Mn)

2.3.2 Global Active Safety Market, by Offerings, 2018, (Thousand Units) (US$ Mn)

2.3.3 Global Active Safety Market, by Vehicle Category, 2018, (Thousand Units) (US$ Mn)

2.3.4 Global Active Safety Market, by End-user, 2018, (Thousand Units) (US$ Mn)

2.3.5 Global Active Safety Market, by Region, 2018, (Thousand Units) (US$ Mn)

2.4 Premium Insights

2.4.1 Active Safety Market In Developed Vs. Developing Economies, 2018 vs 2023

2.4.2 Global Active Safety Market: Regional Life Cycle Analysis

Chapter 3 Market Dynamics

3.1 Market Overview

3.2 Market Drivers

3.2.1 Increasing number of accidents over the years is major factor resulting to the rise in the demand for active safety

3.2.2 Driver 2

3.2.3 Driver 3

3.3 Market Restraints

3.3.1 High maintenance cost is a major factor restraining the market

3.3.2 Restraint 2

3.4 Market Opportunities

3.4.1 Rising government regulations towards safety features in different countries is generating new opportunity to the market

3.4.2 Opportunity 2

3.5 Industry Value Chain Analysis

3.5.1 Analyst’s Views

3.6 Industry SWOT Analysis

Chapter 4 Global Active Safety Market, by Type

4.1 Market Overview, by Type

4.1.1 Global Active Safety Market, by Type, 2017-2028 (Thousand Units) (US$ Mn)

4.1.2 Incremental Opportunity, by Type, From 2017-2028

4.2 Blind Spot Detection

4.2.1 Global Active Safety Market, by Blind Spot Detection, 2017-2028, (Thousand Units) (US$ Mn)

4.3 Collision Avoidance/Warning System

4.3.1 Global Active Safety Market, by Collision Avoidance/Warning System, 2017-2028, (Thousand Units) (US$ Mn)

4.4 Early Warning of Severe Braking ahead

4.4.1 Global Active Safety Market, by Early Warning of Severe Braking ahead, 2017-2028, (Thousand Units) (US$ Mn)

4.5 HUDs

4.5.1 Global Active Safety Market, by HUDs, 2017-2028, (Thousand Units) (US$ Mn)

4.6 ABS

4.6.1 Global Active Safety Market, by ABS, 2017-2028, (Thousand Units) (US$ Mn)

4.7 Electronic Stability Control

4.7.1 Global Active Safety Market, by Electronic Stability Control, 2017-2028, (Thousand Units) (US$ Mn)

4.8 Traction Control

4.8.1 Global Active Safety Market, by Traction Control, 2017-2028, (Thousand Units) (US$ Mn)

4.9 Brake Assist

4.9.1 Global Active Safety Market, by Brake Assist, 2017-2028, (Thousand Units) (US$ Mn)

4.10 Cruise Control System

4.10.1 Global Active Safety Market, by Cruise Control System, 2017-2028, (Thousand Units) (US$ Mn)

4.11 Manual Override for central locking system

4.11.1 Global Active Safety Market, by Manual Override for Central Locking System, 2017-2028, (Thousand Units) (US$ Mn)

4.12 Others

4.12.1 Global Active Safety Market, by Others, 2017-2028, (Thousand Units) (US$ Mn)

Chapter 5 Global Active Safety Market, by Offering

5.1 Market Overview, by Offering

5.1.1 Global Active Safety Market, by Offering, 2017-2028 (Thousand Units) (US$ Mn)

5.1.2 Incremental Opportunity, by Offering, From 2017-2028

5.2 Hardware

5.2.1 Global Active Safety Market, by Hardware, 2017-2028 (Thousand Units) (US$ Mn)

5.2.1.1 Devices

5.2.1.1.1 Global Active Safety Market, by Devices, 2017-2028 (Thousand Units) (US$ Mn)

5.2.1.1.2 Camera

5.2.1.1.2.1 Global Active Safety Market, by Camera, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.1.3 Vision Systems

5.2.1.1.3.1 Global Active Safety Market, by Vision Systems, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.1.4 RADAR Systems

5.2.1.1.4.1 Global Active Safety Market, by RADAR Systems, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.1.5 Ultrasonic Systems

5.2.1.1.5.1 Global Active Safety Market, by Ultrasonic Systems, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2 Sensors & Modules

5.2.1.2.1 Global Active Safety Market, by Sensors & Modules, 2017-2028 (Thousand Units) (US$ Mn)

5.2.1.2.2 Image Sensors

5.2.1.2.2.1 Global Active Safety Market, by Image Sensors, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2.3 Thermal Sensors

5.2.1.2.3.1 Global Active Safety Market, by Thermal Sensors, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2.4 Acoustic Sensors

5.2.1.2.4.1 Global Active Safety Market, by Acoustic Sensors, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2.5 Ambience Sensors

5.2.1.2.5.1 Global Active Safety Market, by Ambience Sensors, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2.6 Position Sensors

5.2.1.2.6.1 Global Active Safety Market, by Position Sensors, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2.7 Gas Sensors

5.2.1.2.7.1 Global Active Safety Market, by Gas Sensors, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2.8 Inertial Sensors

5.2.1.2.8.1 Global Active Safety Market, by Inertial Sensors, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2.9 Proximity Sensors

5.2.1.2.9.1 Global Active Safety Market, by Proximity Sensors, 2017-2028, (Thousand Units) (US$ Mn)

5.2.1.2.10 Others

5.2.1.2.10.1 Global Active Safety Market, by Others, 2017-2028, (Thousand Units) (US$ Mn)

5.3 Technologies

5.3.1 Global Active Safety Market, by Technologies, 2017-2028, (Thousand Units) (US$ Mn)

5.4 Software/Solutions

5.4.1 Global Active Safety Market, by Software/Solutions, 2017-2028, (Thousand Units) (US$ Mn)

Chapter 6 Global Active Safety Market, by Vehicle Category

6.1 Market Overview, by Vehicle Category

6.1.1 Global Active Safety Market, by Vehicle Category, 2017-2028 (Thousand Units) (US$ Mn)

6.1.2 Incremental Opportunity, by Vehicle Category, From 2017-2028

6.2 Passenger Cars

6.2.1 Global Active Safety Market, by Passenger Cars, 2017-2028 (Thousand Units) (US$ Mn)

6.2.1.1 Hatchbacks

6.2.1.1.1 Global Active Safety Market, by Hatchbacks, 2017-2028, (Thousand Units) (US$ Mn)

6.2.1.2 Premium Hatchbacks

6.2.1.2.1 Global Active Safety Market, by Premium Hatchbacks, 2017-2028, (Thousand Units) (US$ Mn)

6.2.1.3 Sedans

6.2.1.3.1 Global Active Safety Market, by Sedans, 2017-2028, (Thousand Units) (US$ Mn)

6.2.1.4 SUV

6.2.1.4.1 Global Active Safety Market, by SUV, 2017-2028, (Thousand Units) (US$ Mn)

6.3 LCV

6.3.1 Global Active Safety Market, by LCV, 2017-2028, (Thousand Units) (US$ Mn)

6.4 Trucks

6.4.1 Global Active Safety Market, by Trucks, 2017-2028, (Thousand Units) (US$ Mn)

6.5 Buses

6.5.1 Global Active Safety Market, by Buses, 2017-2028, (Thousand Units) (US$ Mn)

Chapter 7 Global Active Safety Market, by End-user

7.1 Market Overview, by End-user

7.1.1 Global Active Safety Market, by End-user, 2017-2028 (Thousand Units) (US$ Mn)

7.1.2 Incremental Opportunity, by End-user, From 2017-2028

7.2 Personal Usage

7.2.1 Global Active Safety Market, by Personal Usage, 2017-2028, (Thousand Units) (US$ Mn)

7.3 Commercial

7.3.1 Global Active Safety Market, by Commercial, 2017-2028 (Thousand Units) (US$ Mn)

7.3.1.1 Cargo Carriers

7.3.1.1.1 Global Active Safety Market, by Cargo Carriers, 2017-2028, (Thousand Units) (US$ Mn)

7.3.1.2 Passenger Carriers

7.3.1.2.1 Global Active Safety Market, by Passenger Carriers, 2017-2028, (Thousand Units) (US$ Mn)

7.3.1.3 Automotive Rental Providers

7.3.1.3.1 Global Active Safety Market, by Automotive Rental Providers, 2017-2028, (Thousand Units) (US$ Mn)

7.4 Public Usage

7.4.1 Global Active Safety Market, by Public Usage, 2017-2028, (Thousand Units) (US$ Mn)

Chapter 8 Global Active Safety Market, by Region

8.1 Market Overview, by Region

8.1.1 Global Active Safety Market, by Region, 2016-2023, (Thousand Units) (US$ Mn)

8.2 Attractive Investment Opportunity, by Region, 2018

8.3 North America Active Safety Market

8.3.1 North America Active Safety Market, by Type, 2017-2028 (Thousand Units) (US$ Mn)

8.3.2 North America Active Safety Market, by Offerings, 2017-2028 (Thousand Units) (US$ Mn)

8.3.3 North America Active Safety Market, by Vehicle Category, 2017-2028 (Thousand Units) (US$ Mn)

8.3.4 North America Active Safety Market, by End-user, 2017-2028 (Thousand Units) (US$ Mn)

8.3.5 United States Country Profile

8.3.5.1 United States Active Safety Market, 2017-2028 (Thousand Units) (US$ Mn)

8.3.6 Canada Country Profile

8.3.6.1 Canada Active Safety Market, 2017-2028 (Thousand Units) (US$ Mn)

8.3.7 Mexico Country Profile

8.4 Europe Active Safety Market

8.4.1 Europe Active Safety Market, by Type, 2017-2028 (Thousand Units) (US$ Mn)

8.4.2 Europe Active Safety Market, by Offerings, 2017-2028 (Thousand Units) (US$ Mn)

8.4.3 Europe Active Safety Market, by Vehicle Category, 2017-2028 (Thousand Units) (US$ Mn)

8.4.4 Europe Active Safety Market, by End-user, 2017-2028 (Thousand Units) (US$ Mn)

8.4.5 United Kingdom Country Profile

8.4.5.1 United Kingdom Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.4.6 Germany Country Profile

8.4.6.1 Germany Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.4.7 France Country Profile

8.4.7.1 France Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.4.8 Rest of Europe

8.4.8.1 Rest of Europe Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.5 Asia Pacific Active Safety Market

8.6 Asia Pacific Active Safety Market

8.6.1 Asia Pacific Active Safety Market, by Type, 2017-2028 (Thousand Units) (US$ Mn)

8.6.2 Asia Pacific Active Safety Market, by Offerings, 2017-2028 (Thousand Units) (US$ Mn)

8.6.3 Asia Pacific Active Safety Market, by Vehicle Category, 2017-2028 (Thousand Units) (US$ Mn)

8.6.4 Asia Pacific Active Safety Market, by End-user, 2017-2028 (Thousand Units) (US$ Mn)

8.6.5 China Country Profile

8.6.5.1 China Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.6.6 Japan Country Profile

8.6.6.1 Japan Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.6.7 India Country Profile

8.6.7.1 India Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.7 Latin America Active Safety Market

8.7.1 Latin America Active Safety Market, by Type, 2017-2028 (Thousand Units) (US$ Mn)

8.7.2 Latin America Active Safety Market, by Offerings, 2017-2028 (Thousand Units) (US$ Mn)

8.7.3 Latin America Active Safety Market, by Vehicle Category, 2017-2028 (Thousand Units) (US$ Mn)

8.7.4 Latin America Active Safety Market, by End-user, 2017-2028 (Thousand Units) (US$ Mn)

8.7.5 Brazil Country Profile

8.7.5.1 Brazil Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.7.6 Argentina Country Profile

8.7.6.1 Argentina Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.7.7 Rest of Latin America

8.7.7.1 Rest of Latin America Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.8 Middle East & Africa Active Safety Market

8.8.1 Middle East & Africa Active Safety Market, by Type, 2017-2028 (Thousand Units) (US$ Mn)

8.8.2 Middle East & Africa Active Safety Market, by Offerings, 2017-2028 (Thousand Units) (US$ Mn)

8.8.3 Middle East & Africa Active Safety Market, by Vehicle Category, 2017-2028 (Thousand Units) (US$ Mn)

8.8.4 Middle East & Africa Active Safety Market, by End-user, 2017-2028 (Thousand Units) (US$ Mn)

8.8.5 GCC

8.8.5.1 GCC Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

8.8.6 Rest of Middle East & Africa

8.8.6.1 Rest of Middle East & Africa Active Safety Market, 2016-2023 (Thousand Units) (US$ Mn)

Chapter 9 Competitive Intelligence

9.1 Introduction

9.2 Players Evaluated During the Study

9.3 Market Players Present in Market Life Cycle

9.4 Top 5 Players Comparison

9.5 Market Positioning of Key Players, 2018

9.6 Market Players Mapping

9.6.1 By Type

9.6.2 By Offerings

9.6.3 By Vehicle Category

9.6.4 By End-user

9.6.5 By Region

9.7 Strategies Adopted by Key Market Players

9.8 Recent Developments in the Market

9.8.1 Mergers & Acquisitions, Partnership, New Product Developments

9.9 Operational Efficiency Comparison by Key Players

Chapter 10 Company Profiles

10.1 Autoliv Inc.

10.1.1 Autoliv Inc. Overview

10.1.2 Key Stakeholders/Person in Autoliv Inc.

10.1.3 Autoliv Inc. Products Portfolio

10.1.4 Autoliv Inc. Financial Overview

10.1.5 Autoliv Inc. News/Recent Developments

10.2 Veoneer

10.2.1 Veoneer Overview

10.2.2 Key Stakeholders/Person in Veoneer

10.2.3 Veoneer Products Portfolio

10.2.4 Veoneer Financial Overview

10.2.5 Veoneer News/Recent Developments

10.3 Robert Bosch GmbH

10.3.1 Robert Bosch GmbH Overview

10.3.2 Key Stakeholders/Person in Robert Bosch GmbH

10.3.3 Robert Bosch GmbH Products Portfolio

10.3.4 Robert Bosch GmbH Financial Overview

10.3.5 Robert Bosch GmbH News/Recent Developments

10.4 Continental AG

10.4.1 Continental AG Overview

10.4.2 Key Stakeholders/Person in Continental AG

10.4.3 Continental AG Products Portfolio

10.4.4 Continental AG Financial Overview

10.4.5 Continental AG News/Recent Developments

10.5 Delphi Automotive LLP

10.5.1 Delphi Automotive LLP Overview

10.5.2 Key Stakeholders/Person in Delphi Automotive LLP

10.5.3 Delphi Automotive LLP Products Portfolio

10.5.4 Delphi Automotive LLP Financial Overview

10.5.5 Delphi Automotive LLP News/Recent Developments

10.6 TRW Automotive

10.6.1 TRW Automotive Overview

10.6.2 Key Stakeholders/Person in TRW Automotive

10.6.3 TRW Automotive Products Portfolio

10.6.4 TRW Automotive Financial Overview

10.6.5 TRW Automotive News/Recent Developments

10.7 Denso Corporation

10.7.1 Denso Corporation Overview

10.7.2 Key Stakeholders/Person in Denso Corporation

10.7.3 Denso Corporation Products Portfolio

10.7.4 Denso Corporation Financial Overview

10.7.5 Denso Corporation News/Recent Developments

10.8 Valeo

10.8.1 Valeo Overview

10.8.2 Key Stakeholders/Person in Valeo

10.8.3 Valeo Products Portfolio

10.8.4 Valeo Financial Overview

10.8.5 Valeo News/Recent Developments

10.9 ZF

10.9.1 ZF Overview

10.9.2 Key Stakeholders/Person in ZF

10.9.3 ZF Products Portfolio

10.9.4 ZF Financial Overview

10.9.5 ZF News/Recent Developments

10.10 Hyundai Mobis

10.10.1 Hyundai Mobis Overview

10.10.2 Key Stakeholders/Person in Hyundai Mobis

10.10.3 Hyundai Mobis Products Portfolio

10.10.4 Hyundai Mobis Financial Overview

10.10.5 Hyundai Mobis News/Recent Developments