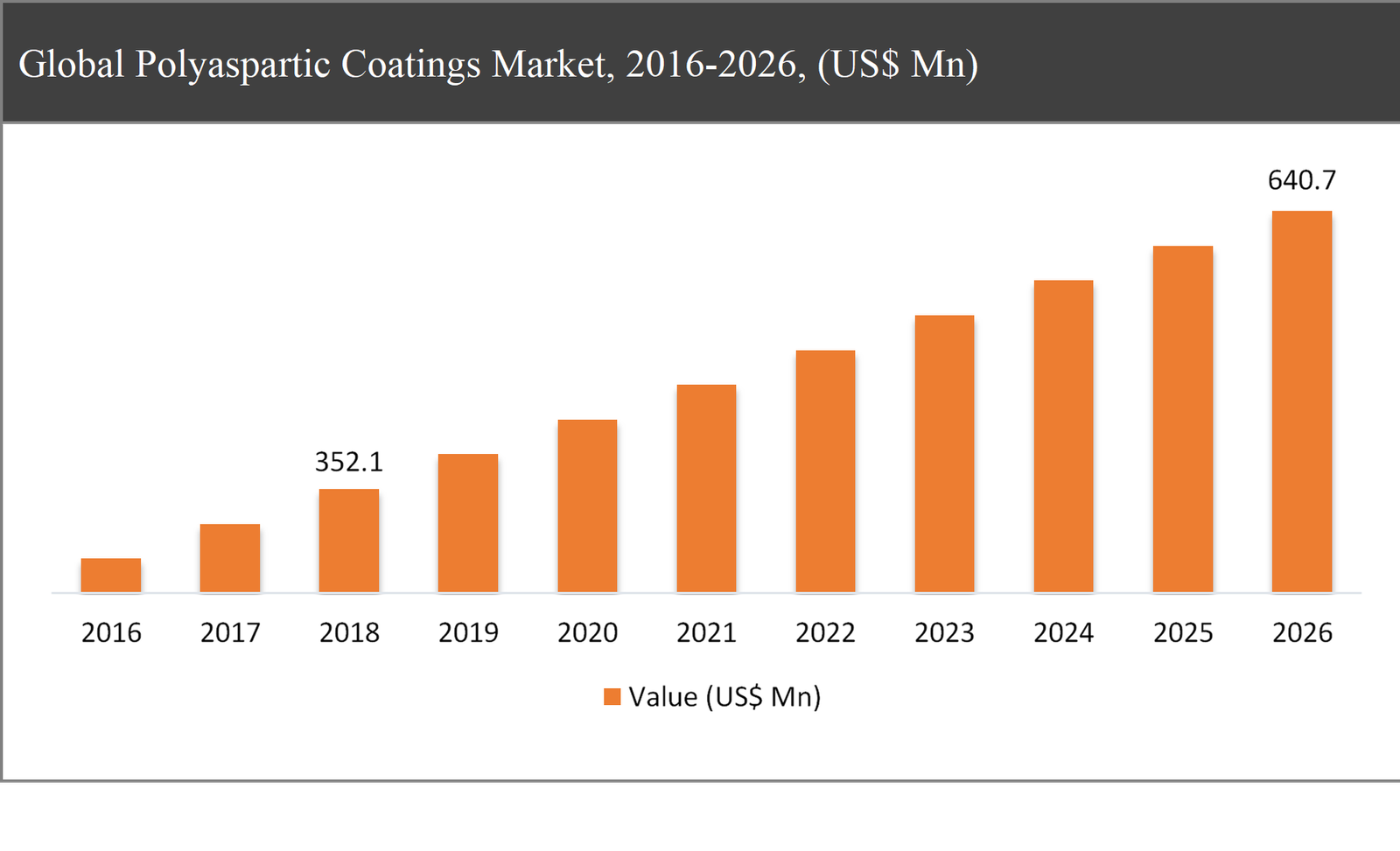

The global polyaspartic coatings market was valued at USD 352.1 million in 2018 and is expected to reach USD 640.7 million in 2026, growing at a CAGR of 7.1% during the forecast period.

Polyaspartic coatings are essentially designed to exhibit features such as rapid curing capabilities, and fast-drying. These coatings can dry in a matter of hours or less.

|

By Product |

|

|

By System |

|

|

By End-use Industry |

|

|

By Region |

|

The growth of the polyaspartic coatings market is primarily driven by the polyaspartic technology which can be applied in various end-use industries by simple manipulation. When compared with regular coatings made of epoxy and polyurethane polyaspartic coatings cure more quickly. These coatings can also be used in low-temperature applications with easy formulations. Typical applications of polyaspartic coatings include coatings for bridges, flooring, OEM coatings, automotive repair, wind turbines, and pipelines in the oil & gas industry, among others.

The pure polyurea segment expected to dominate the market throughout the forecast period

Based on product, the global polyaspartic coatings market has been segmented into pure polyurea and hybrid polyurea. The pure polyurea of polyaspartic coatings accounted for approximately 54% of the share in the global polyaspartic coatings market in 2018.

While hybrid polyurea accounted highest CAGR of around 9% in the global polyaspartic coatings market during the forecast period. Hybrid polyurea is widely adopted for its easy availability and low cost. These benefits are expected to enhance the demand and sales for hybrid polyurea across the developed and developing countries in the global market.

Based on the systems, the quartz segment is expected to grow at a CAGR of around 10% throughout the forecast period

Based on the system, the polyaspartic coatings market has been segmented into quartz, and metallic. The quartz Product systems segment accounts of the largest share in the market and are expected to grow at a CAGR of around 10% during the forecast period.

Based on the end-use industry, the building & construction segment is expected to dominate during the forecast period

Based on the end-use industry, the polyaspartic coatings market has been segmented into building & construction, and transportation among others. The building & construction segment accounts of the largest share in the market and held for more than 30% of the total market in 2018. The major factors that are driving the growth of this segment are the rising rate of infrastructure development across developing countries such as India, China, and Indonesia.

Asia-Pacific to dominate the polyaspartic coatings market throughout the forecast period

Asia-Pacific accounted for nearly 36% share of the global polyaspartic coatings market in 2018 and is expected to dominate the market throughout the forecast period. The rapid growth in the building & construction sector is one of the major driving factors for the region in the global market. Moreover, the increasing awareness for hybrid polyaspartic coatings and the presence of local manufacturers increases its dominance in the global polyaspartic coatings market in the future.

North America is expected to hold the highest CAGR in the global market during the forecast period. The manufacturers are investing in North American countries to meet the demand for the transportation sector.

Company Profiles and Competitive Intelligence in Polyaspartic Coatings Market Report are:

The major players operating in the global polyaspartic coatings market are Covestro AG (Germany), Hempel Group (Denmark), The Sherwin-Williams Company (US), Rust-Oleum (US), Laticrete (US), PPG Industries (US), BASF SE (Germany), AkzoNobel (Netherlands), SIKA AG (Switzerland), and Satyen polymers (India) among others.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Chapter 1 Executive Summary

1.1. Market Summary

1.1.1. Global Polyaspartic Coatings Market, 2016-2026, (USD Million)

1.2. Market Snapshot: Global Polyaspartic Coatings Market

1.3. Market Dynamics

1.4. Global Polyaspartic Coatings Market, by Segment, 2018

1.4.1. Global Polyaspartic Coatings Market, by Product, 2018, (USD Million)

1.4.2. Global Polyaspartic Coatings Market, by System, 2018, (USD Million)

1.4.3. Global Polyaspartic Coatings Market, by End Use Industry, 2018, (USD Million)

1.4.4. Global Polyaspartic Coatings Market, by Region, 2018 (USD Million)

1.5. Premium Insights

1.5.1. Polyaspartic Coatings Market In Developed Vs. Developing Economies, 2018 vs 2023

1.5.2. Global Polyaspartic Coatings Market: Regional Life Cycle Analysis

Chapter 2 Market Dynamics

2.1. Market Overview

2.2. Market Drivers

2.2.1. Benefits of polyaspartic coatings in terms of light and temperature resistance

2.2.2. Rising rate of infrastructure development

2.3. Market Restraints

2.3.1. Fluctuating prices of raw material

2.3.2. High cost

2.4. Market Opportunities

2.4.1. Advancements in technology

2.5. Industry Value Chain Analysis

2.6. Pricing Analysis

2.7. Porter’s Five Forces Analysis

Chapter 3 Global Polyaspartic Coatings Market, by Product

3.1. Market Overview, by Product

3.1.1. Global Polyaspartic Coatings Market, by Country, 2016-2026 (USD Million)

3.1.2. Incremental Opportunity, by Product, 2018

3.2. Pure Polyurea

3.2.1. Global Polyaspartic Coatings Market, by Pure Polyurea, 2016-2026, (USD Million)

3.3. Hybrid Polyurea

3.3.1. Global Polyaspartic Coatings Market, by Hybrid Polyurea, 2016-2026, (USD Million)

Chapter 4 Global Polyaspartic Coatings Market, by System

4.1. Market Overview, by System

4.1.1. Global Polyaspartic Coatings Market, by System, 2016-2026 (USD Million)

4.1.2. Incremental Opportunity, by System, 2018

4.2. Quartz

4.2.1. Global Polyaspartic Coatings Market, by Quartz, 2016-2026, (USD Million)

4.3. Metallic

4.3.1. Global Polyaspartic Coatings Market, by Metallic, 2016-2026, (USD Million)

Chapter 5 Global Polyaspartic Coatings Market, by End Use Industry

5.1. Market Overview, by End Use Industry

5.1.1. Global Polyaspartic Coatings Market, by End Use Industry, 2016-2026 (USD Million)

5.1.2. Incremental Opportunity, by End Use Industry, 2018

5.2. Building & Construction

5.2.1. Global Polyaspartic Coatings Market, by Building & Construction, 2016-2026, (USD Million)

5.3. Transportation

5.3.1. Global Polyaspartic Coatings Market, by Transportation, 2016-2026, (USD Million)

5.4. Others

5.4.1. Global Polyaspartic Coatings Market, by Others, 2016-2026, (USD Million)

Chapter 6 Global Polyaspartic Coatings Market, by Region

6.1. Market Overview, by Region

6.1.1. Global Polyaspartic Coatings Market, by Region, 2016-2026, (USD Million)

6.2. Attractive Investment Opportunity, by Region, 2018

6.2.1. North America Polyaspartic Coatings Market by Product 2016-2026 (USD Million)

6.2.2. North America Polyaspartic Coatings Market by System 2016-2026 (USD Million)

6.2.3. North America Polyaspartic Coatings Market, by End Use Industry 2016-2026 (USD Million)

6.2.4. United States Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.2.5. Canada Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.3. Europe Polyaspartic Coatings Market

6.3.1. Europe Polyaspartic Coatings Market by Product 2016-2026 (USD Million)

6.3.2. Europe Polyaspartic Coatings Market by System 2016-2026 (USD Million)

6.3.3. Europe Polyaspartic Coatings Market, by End Use Industry 2016-2026 (USD Million)

6.3.4. United Kingdom Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.3.5. Germany Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.3.6. France Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.3.7. Rest of Europe Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.4. Asia Pacific Polyaspartic Coatings Market

6.4.1. Asia Pacific Polyaspartic Coatings Market by Product 2016-2026 (USD Million)

6.4.2. Asia Pacific Polyaspartic Coatings Market by System 2016-2026 (USD Million)

6.4.3. Asia Pacific Polyaspartic Coatings Market, by End Use Industry 2016-2026 (USD Million)

6.4.4. China Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.4.5. Japan Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.4.6. India Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.4.7. Rest of Asia Pacific Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.5. Latin America Polyaspartic Coatings Market

6.5.1. Latin America Polyaspartic Coatings Market by Product 2016-2026 (USD Million)

6.5.2. Latin America Polyaspartic Coatings Market by System 2016-2026 (USD Million)

6.5.3. Latin America Polyaspartic Coatings Market, by End Use Industry 2016-2026 (USD Million)

6.5.4. Brazil Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.5.5. Mexico Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.5.6. Rest of Latin America Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.6. Middle East & Africa Polyaspartic Coatings Market

6.6.1. Middle East & Africa Polyaspartic Coatings Market by Product 2016-2026 (USD Million)

6.6.2. Middle East & Africa Polyaspartic Coatings Market by System 2016-2026 (USD Million)

6.6.3. Middle East & Africa Polyaspartic Coatings Market, by End Use Industry 2016-2026 (USD Million)

6.6.4. GCC Polyaspartic Coatings Market, 2016-2026 (USD Million)

6.6.5. Rest of Middle East & Africa Polyaspartic Coatings Market, 2016-2026 (USD Million)

Chapter 7 Competitive Intelligence

7.1. Top 5 Players Comparison

7.2. Market Positioning of Key Players, 2018

7.3. Market Players Mapping

7.3.1. By Product

7.3.2. By System

7.3.3. By End Use Industry

7.3.4. By Region

7.4. Strategies Adopted by Key Market Players

7.5. Recent Developments in the Market

7.5.1. Mergers & Acquisitions, Partnership, New Product Developments

Chapter 8 Company Profiles

8.1. Covestro AG

8.1.1. Covestro AG Overview

8.1.2. Covestro AG Products Portfolio

8.1.3. Covestro AG Financial Overview

8.1.4. Covestro AG News/Recent Developments

8.2. The Sherwin-Williams Company

8.2.1. The Sherwin-Williams Company Overview

8.2.2. The Sherwin-Williams Company Products Portfolio

8.2.3. The Sherwin-Williams Company Financial Overview

8.2.4. The Sherwin-Williams Company News/Recent Developments

8.3. PPG Industries

8.3.1. PPG Industries Overview

8.3.2. PPG Industries Products Portfolio

8.3.3. PPG Industries Financial Overview

8.3.4. PPG Industries News/Recent Developments

8.4. Akzonobel

8.4.1. Akzonobel Overview

8.4.2. Akzonobel Products Portfolio

8.4.3. Akzonobel Financial Overview

8.4.4. Akzonobel News/Recent Developments

8.5. BASF SE

8.5.1. BASF SE Overview

8.5.2. BASF SE Products Portfolio

8.5.3. BASF SE Financial Overview

8.5.4. BASF SE News/Recent Developments

8.6. Hempel

8.6.1. Hempel Overview

8.6.2. Hempel Products Portfolio

8.6.3. Hempel Financial Overview

8.6.4. Hempel News/Recent Developments

8.7. SIKA AG

8.7.1. SIKA AG Overview

8.7.2. SIKA AG Products Portfolio

8.7.3. SIKA AG Financial Overview

8.7.4. SIKA AG News/Recent Developments

8.8. Carboline

8.8.1. Carboline Overview

8.8.2. Carboline Products Portfolio

8.8.3. Carboline Financial Overview

8.8.4. Carboline News/Recent Developments

8.9. Rust-Oleum

8.9.1. Rust-Oleum Overview

8.9.2. Rust-Oleum Products Portfolio

8.9.3. Rust-Oleum Financial Overview

8.9.4. Rust-Oleum News/Recent Developments

8.10. Laticrete International

8.10.1. Laticrete International Overview

8.10.2. Laticrete International Products Portfolio

8.10.3. Laticrete International Financial Overview

8.10.4. Laticrete International News/Recent Developments

Chapter 9 Preface

9.1. Data Triangulation

9.2. Research Methodology

9.2.1. Phase I – Secondary Research

9.2.2. Phase II – Primary Research

9.2.3. Phase III – Expert Panel Review

9.2.4. Approach Adopted

9.2.4.1. Top-Down Approach

9.2.4.2. Bottom-Up Approach

9.2.5. Supply- Demand side

9.2.6. Breakup of the Primary Profiles