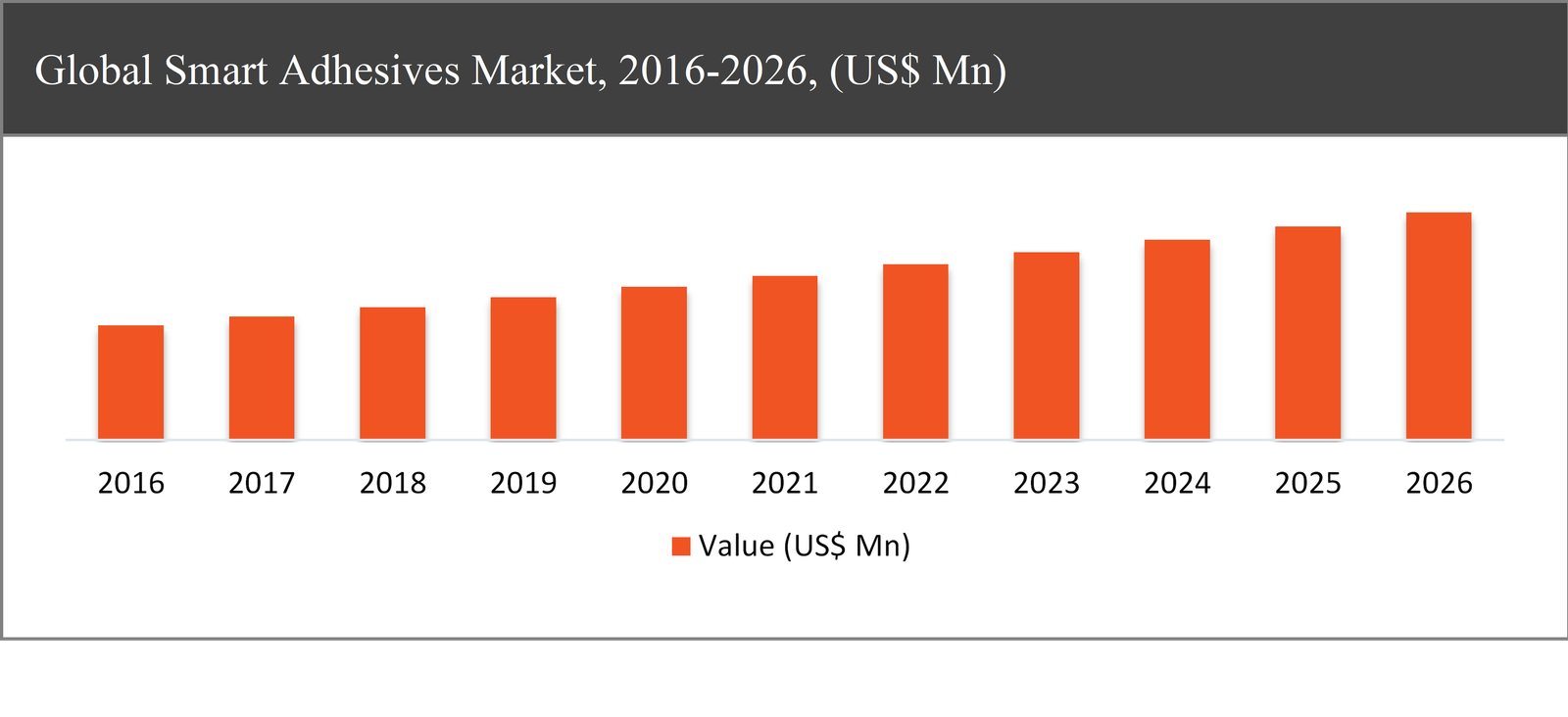

The global smart adhesives market is expected to grow at a CAGR of 12% during the forecast period. Smart adhesives have gained prominence in various manufacturing industries, which include building & construction, packaging, personal hygiene, bookbinding, automotive, and wood industry. The smart adhesive has some beneficial properties such as quick setting time, balanced humidity, resistance to moisture and can be used in other environmental conditions due to which it is widely used in various industries. Advantages of the smart adhesive include better adhesion and cohesion and excellent binding with substrates that further encourages the demand for smart adhesives in various applications.

|

By Technology |

|

|

By Application |

|

|

By Region |

|

Based on technology, the hot melt adhesives segment is expected to lead during the forecast period

Based on technology, the smart adhesives market has been segmented into water-based, hot melt adhesives, solvent-based, and others. The hot melt adhesive segment is projected to have the largest share in the global market. Due to the various benefits offered by hot wax adhesives across industries, there is an increase in demand for hot melts, spurring the production of smart adhesives. There is the demand for some form of industrial adhesive in many manufacturing and distribution companies for their production line. It is used across many industries from packaging alcoholic beverages to binding books, assembling furniture, or stamp and envelope production. All these industries have an increasing demand for reliable, quality smart adhesives.

The automotive & transportation segment expected to grow at the fastest rate of 14.4% CAGR during the forecast period

Based on application, the global smart adhesives market has been segmented into building & construction, automotive & transportation, packaging, consumer, and others. The automotive and transportation market is projected to be the fastest-growing segment during the forecast period. Smart adhesives are a critical component of the automotive manufacturing industry. Smart adhesives such hot melt adhesives are largely used in automotive production because they are ideal for bonds that need flexibility and movement, such as contraction and expansion. The smart adhesive is also suitable for adhering materials having different thermal expansion properties. It creates tough, impact-resistant bonds that are chemical and weather resistant and have a high abrasion resistance as well as high shear strength, therefore, creating significance in the automotive industry thus propel the smart adhesives market growth.

Asia-Pacific to dominate the smart adhesives market throughout the forecast period

Asia-Pacific accounted for the highest share in the global smart adhesives market in 2018 and is expected to dominate the market throughout the forecast period followed by North America and Europe. The growth in the Asia -Pacific region is attributed to the growing demand for smart adhesives in the building & construction, automotive and packaging industries. The increasing demand for packaged products in various industries such as food & beverages and e-commerce is also boosting the market growth. For instance, the Indian pharmaceutical market has been growing due to which the demand for packaging will increase. The demand for packaging has been steadily increasing in APAC, especially in countries, such as, India, China, and among other South Asian countries, due to steady growth in the food-processing sector that further contributes to market growth.

Company Profiles and Competitive Intelligence in Smart Adhesives Market Report are:

The major players operating in the global smart adhesives market are Bostik SA (US), The Dow Chemical Company (US), Mapei Construction Products India Pvt Ltd (Italy), 3M Company (US), H.B. Fuller Company (US), Henkel Corporation (Germany), Sika AG (Switzerland), Huntsman Corporation (US), Akzo Nobel N.V. (Netherlands), Delo Industrie Klebstoffe GmbH & Co. KGaA (Germany) among others.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

Chapter 1 Executive Summary

1.1. Market Summary

1.1.1. Global Smart Adhesives Market, 2016-2026, (USD Million)

1.2. Market Snapshot: Global Smart Adhesives Market

1.3. Market Dynamics

1.4. Global Smart Adhesives Market, by Segment, 2018

1.4.1. Global Smart Adhesives Market, by Technology, 2018, (USD Million)

1.4.2. Global Smart Adhesives Market, by Application, 2018, (USD Million)

1.4.3. Global Smart Adhesives Market, by Region, 2018 (USD Million)

1.5. Premium Insights

1.5.1. Smart Adhesives Market in Developed Vs. Developing Economies, 2018 vs 2026

1.5.2. Global Smart Adhesives Market: Regional Life Cycle Analysis

Chapter 2 Market Dynamics

2.1. Market Overview

2.2. Market Drivers

2.2.1. Increasing application of adhesives in various industry such as Automotive, building & Construction

2.2.2. Shift in preference to hot-melt adhesives

2.2.3. Growing demand of adhesives in emerging market

2.3. Market Restraints

2.3.1. Stringent government regulations

2.4. Market Opportunities

2.4.1. Increasing demand of bio-based adhesives

2.5. Industry Value Chain Analysis

2.6. Pricing Analysis

2.7. Porter’s Five Forces Analysis

Chapter 3 Global Smart Adhesives Market, by Technology

3.1. Market Overview, by Technology

3.1.1. Global Smart Adhesives Market, by Technology, 2016-2026 (USD Million)

3.1.2. Incremental Opportunity, by Technology, 2018

3.2. Water-based

3.2.1. Global Smart Adhesives Market, by Water-based, 2016-2026, (USD Million)

3.3. Hot melt adhesives

3.3.1. Global Smart Adhesives Market, by Hot melt adhesives, 2016-2026, (USD Million)

3.4. Solvent-based

3.4.1. Global Smart Adhesives Market, by Solvent-based, 2016-2026, (USD Million)

3.5. Others

3.5.1. Global Smart Adhesives Market, by Others, 2016-2026, (USD Million)

Chapter 4 Global Smart Adhesives Market, by Application

4.1. Market Overview, by Application

4.1.1. Global Smart Adhesives Market, by Application, 2016-2026 (USD Million)

4.1.2. Incremental Opportunity, by Application, 2018

4.2. Building and Construction

4.2.1. Global Smart Adhesives Market, by Building and Construction, 2016-2026, (USD Million)

4.3. Automotive and Transportation

4.3.1. Global Smart Adhesives Market, by Automotive and Transportation, 2016-2026, (USD Million)

4.4. Packaging

4.4.1. Global Smart Adhesives Market, by Packaging, 2016-2026, (USD Million)

4.5. Consumer

4.5.1. Global Smart Adhesives Market, by Consumer, 2016-2026, (USD Million)

4.6. Others

4.6.1. Global Smart Adhesives Market, by Others, 2016-2026, (USD Million)

Chapter 5 Global Smart Adhesives Market, by Region

5.1. Market Overview, by Region

5.1.1. Global Smart Adhesives Market, by Region, 2016-2026, (USD Million)

5.2. Attractive Investment Opportunity, by Region, 2018

5.3. North America Smart Adhesives Market

5.3.1. North America Smart Adhesives Market, by Technology, 2016-2026 (USD Million)

5.3.2. North America Smart Adhesives Market, by Application, 2016-2026 (USD Million)

5.3.3. United States Smart Adhesives Market, 2016-2026 (USD Million)

5.3.4. Canada Smart Adhesives Market, 2016-2026 (USD Million)

5.4. Europe Smart Adhesives Market

5.4.1. Europe Smart Adhesives Market, by Technology, 2016-2026 (USD Million)

5.4.2. Europe Smart Adhesives Market, by Application, 2016-2026 (USD Million)

5.4.3. United Kingdom Smart Adhesives Market, 2016-2026 (USD Million)

5.4.4. Germany Smart Adhesives Market, 2016-2026 (USD Million)

5.4.5. France Smart Adhesives Market, 2016-2026 (USD Million)

5.4.6. Rest of Europe Smart Adhesives Market, 2016-2026 (USD Million)

5.5. Asia Pacific Smart Adhesives Market

5.5.1. Asia Pacific Smart Adhesives Market, by Technology, 2016-2026 (USD Million)

5.5.2. Asia Pacific Smart Adhesives Market, by Application, 2016-2026 (USD Million)

5.5.3. China Smart Adhesives Market, 2016-2026 (USD Million)

5.5.4. Japan Smart Adhesives Market, 2016-2026 (USD Million)

5.5.5. India Smart Adhesives Market, 2016-2026 (USD Million)

5.5.6. Rest of Asia Pacific Smart Adhesives Market, 2016-2026 (USD Million)

5.6. Latin America Smart Adhesives Market

5.6.1. Latin America Smart Adhesives Market, by Technology, 2016-2026 (USD Million)

5.6.2. Latin America Smart Adhesives Market, by Application, 2016-2026 (USD Million)

5.6.3. Brazil Smart Adhesives Market, 2016-2026 (USD Million)

5.6.4. Mexico Smart Adhesives Market, 2016-2026 (USD Million)

5.6.5. Rest of Latin America Smart Adhesives Market, 2016-2026 (USD Million)

5.7. Middle East & Africa Smart Adhesives Market

5.7.1. Middle East & Africa Smart Adhesives Market, by Technology, 2016-2026 (USD Million)

5.7.2. Middle East & Africa Smart Adhesives Market, by Application, 2016-2026 (USD Million)

5.7.3. GCC Smart Adhesives Market, 2016-2026 (USD Million)

5.7.4. Rest of Middle East & Africa Smart Adhesives Market, 2016-2026 (USD Million)

Chapter 6 Competitive Intelligence

6.1. Top 5 Players Comparison

6.2. Market Positioning of Key Players, 2018

6.3. Market Players Mapping

6.3.1. By Technology

6.3.2. By Application

6.3.3. By Region

6.4. Strategies Adopted by Key Market Players

6.5. Recent Developments in the Market

6.5.1. Mergers & Acquisitions, Partnership, New Product Developments

Chapter 7 Company Profiles

7.1. Bostik SA

7.1.1. Bostik SA Overview

7.1.2. Bostik SA Products Portfolio

7.1.3. Bostik SA Financial Overview

7.1.4. Bostik SA News/Recent Developments

7.2. The Dow Chemical Company

7.2.1. The Dow Chemical Company Overview

7.2.2. The Dow Chemical Company Products Portfolio

7.2.3. The Dow Chemical Company Financial Overview

7.2.4. The Dow Chemical Company News/Recent Developments

7.3. Mapei Construction Products India Pvt Ltd

7.3.1. Mapei Construction Products India Pvt Ltd Overview

7.3.2. Mapei Construction Products India Pvt Ltd Products Portfolio

7.3.3. Mapei Construction Products India Pvt Ltd Financial Overview

7.3.4. Mapei Construction Products India Pvt Ltd News/Recent Developments

7.4. 3M Company

7.4.1. 3M Company Overview

7.4.2. 3M Company Products Portfolio

7.4.3. 3M Company Financial Overview

7.4.4. 3M Company News/Recent Developments

7.5. H.B. Fuller Company

7.5.1. H.B. Fuller Company Overview

7.5.2. H.B. Fuller Company Products Portfolio

7.5.3. H.B. Fuller Company Financial Overview

7.5.4. H.B. Fuller Company News/Recent Developments

7.6. Henkel Corporation

7.6.1. Henkel Corporation Overview

7.6.2. Henkel Corporation Products Portfolio

7.6.3. Henkel Corporation Financial Overview

7.6.4. Henkel Corporation News/Recent Developments

7.7. Sika AG

7.7.1. Sika AG Overview

7.7.2. Sika AG Products Portfolio

7.7.3. Sika AG Financial Overview

7.7.4. Sika AG News/Recent Developments

7.8. Huntsman Corporation

7.8.1. Huntsman Corporation Overview

7.8.2. Huntsman Corporation Products Portfolio

7.8.3. Huntsman Corporation Financial Overview

7.8.4. Huntsman Corporation News/Recent Developments

7.9. Akzo Nobel N.V.

7.9.1. Akzo Nobel N.V. Overview

7.9.2. Akzo Nobel N.V. Products Portfolio

7.9.3. Akzo Nobel N.V. Financial Overview

7.9.4. Akzo Nobel N.V. News/Recent Developments

7.10. Delo Industrie Klebstoffe GmbH & Co. KGaA

7.10.1. Delo Industrie Klebstoffe GmbH & Co. KGaA Overview

7.10.2. Delo Industrie Klebstoffe GmbH & Co. KGaA Products Portfolio

7.10.3. Delo Industrie Klebstoffe GmbH & Co. KGaA Financial Overview

7.10.4. Delo Industrie Klebstoffe GmbH & Co. KGaA News/Recent Developments

Chapter 8 Preface

8.1. Data Triangulation

8.2. Research Methodology

8.2.1. Application I – Secondary Research

8.2.2. Application II – Primary Research

8.2.3. Application III – Expert Panel Review

8.2.4. Approach Adopted

8.2.4.1. Top-Down Approach

8.2.4.2. Bottom-Up Approach

8.2.5. Supply- Demand side

8.2.6. Breakup of the Primary Profiles