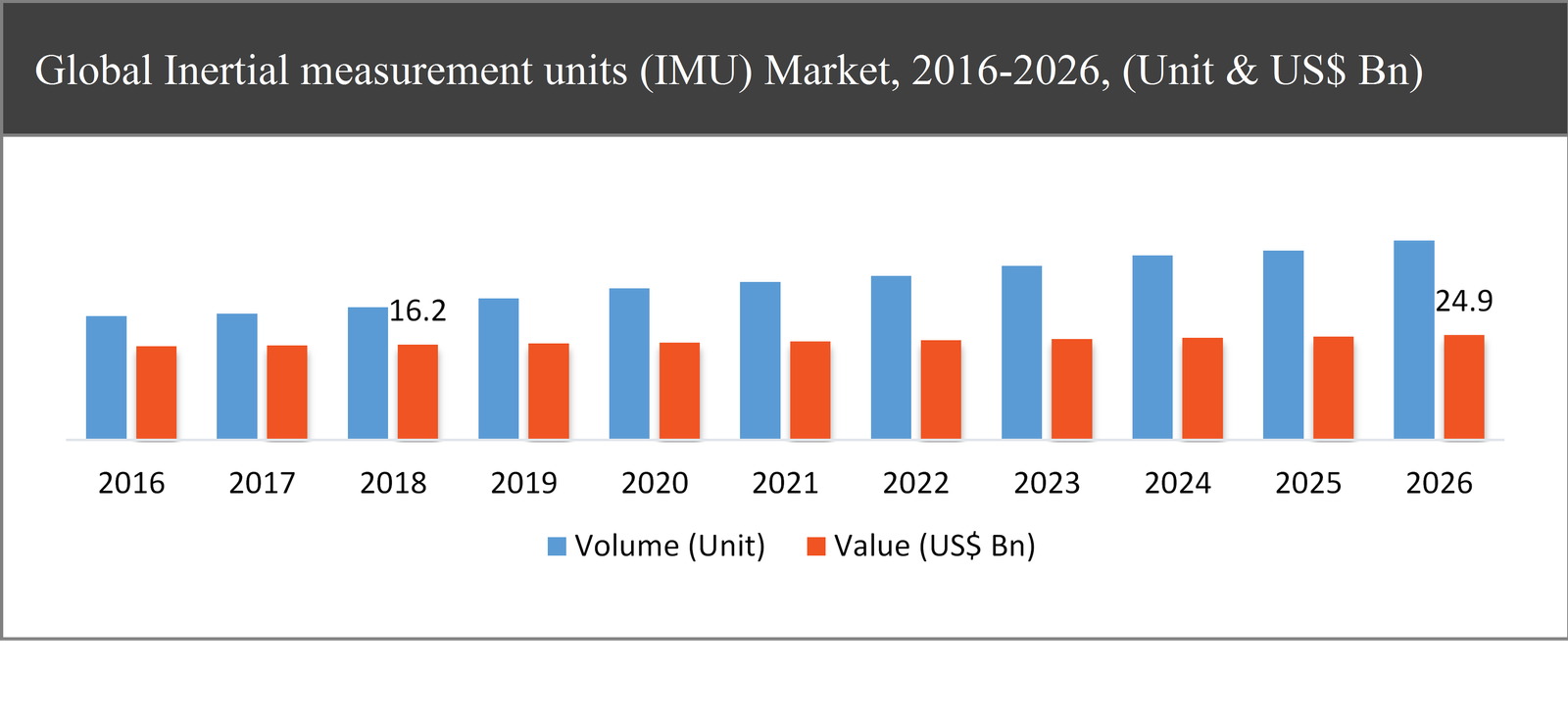

The global Inertial measurement units (IMU) market was valued at USD 16.2 billion in 2018 and is expected to reach USD 24.9 billion in 2026, growing at a CAGR of 5.59% during the forecast period.

Inertial measurement units (IMU) functions as an electronic device used mainly to measure and analyses the velocity, gravitational forces, and orientation by using gyroscopes and accelerometers, and magnetometers.

The growth of the IMU market is primarily driven by tracking real-time vehicle’s position with respect to inclination, growing demand for accuracy in navigation, growing production and sales of smartphones, increase in demand for aircraft and missiles due to changing nature of warfare and fewer costs of miniaturized components. Moreover, rising demand from growing end-use industries, such as automotive & transportation, consumer electronics, and aerospace and defense sectors in emerging countries also drive the growth of the global IMU market. On the other hand, high operational and maintenance costs along with operational complexity and less defense budget in developing countries are creating a major hindrance to its market growth. However, continuous development in commercial driverless vehicles and MEMS-Based IMU and growing advancement in Virtual Reality (VR) and Augmented Reality (AR) technologies are expected to create major growth opportunities during the forecast period.

|

By Component |

|

|

By Technology |

|

|

By Application |

|

|

By Grade |

|

|

By Region |

|

The gyroscopes segment expected to grow at the fastest rate of 7.2% CAGR during the forecast period

Based on the component, the global IMU market has been segmented into accelerometers, gyroscopes, and magnetometers. Due to its excellent properties like high durability and enhanced accuracy, navigation techniques are the most widely used IMU across the end-use industries, globally. The growing use of gyroscopes in aerospace & defense, industrial, automotive, and marine further grows the demand for gyroscopes in the global IMU market during the forecast period. Due to these factors, gyroscopes are expected to grow at the fastest rate throughout the forecast period.

The MEMS segment expected to grow at the fastest rate of 7.7% CAGR during the forecast period

Based on technology, the global IMU market has been segmented into mechanical gyro, ring laser gyro, fiber optics gyro, MEMS, and others. The MEMS technology is widely used in various applications due to an increase in demand for low-cost sensors, improve accuracy in devices, and growing development for integrating several sensors with electronic devices. Due to these factors, MEMS is expected to grow at the fastest rate throughout the forecast period.

Based on application, the consumer electronics segment is expected to lead during the forecast period

Based on application, the market has been segmented into aerospace & defense, marine, automotive, consumer electronics, and others. The consumer electronics segment is accounted for the largest share in the market and held for around 28% of the total market, in 2018. Owing to its growing production and sales of smartphones, growing demand for smartphones in India, Nigeria, and Pakistan, and high production and demand for smartphones China, the US, Brazil, Japan, and others further grows the demand for IMU in consumer electronics applications.

Based on grade, the commercial grade segment is expected to lead during the forecast period

Based on grade, the market has been segmented into marine grade, navigation grade, tactical grade, space-grade, and commercial grade. The commercial-grade segment is accounted for the largest share in the market and held for around 37% of the total market, in 2018. The growth of this segment is due to the growing demand for IMUs in the automotive industry, growing demand for smartphones in developed, as well as developed countries and demand for VR/AR further, grows the demand for commercial grade IMU.

Asia-Pacific to dominate the IMU market throughout the forecast period

Asia-Pacific accounted for nearly 33% share of the global IMU market in 2018 and is expected to dominate the market throughout the forecast period followed by Europe and North America. Growing consumer electrics, marine and defense, and automotive industry and strong economic growth in the Asia-Pacific region is one of the key factors driving the consumption of IMU in this region. Moreover, the increase in demand for smart phones, smart watches, etc in key countries such as Japan, India, and China are also propelling the growth of IMU in the Asia-Pacific region. Major smartphone manufacturers such as Oppo (china), Vivo (China) and aircraft manufacturers such as COMAC (China) and Mitsubishi Aircraft Corporation (Japan) further grow the demand for IMU in Asia-Pacific. Europe accounted for the highest CAGR in the global IMU market during the forecast period.

Company Profiles and Competitive Intelligence:

The major players operating in the global IMU market are Northrop Grumman (US), Thales (France), Teledyne Technologies (US), LORD MicroStrain (US), Honeywell (US), Safran Electronics & Defense (France), Bosch Sensortec GmbH (Germany), Moog Inc. (US), Trimble Navigation (US), and Gladiator Technologies (US) among others.

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports

TABLE OF CONTENTS

Chapter 1 Executive Summary

1.1. Market Summary

1.1.1. Global IMU Market, 2016-2026, (Unit) (USD Million)

1.2. Market Snapshot: Global IMU Market

1.3. Market Dynamics

1.4. Global IMU Market, by Segment, 2018

1.4.1. Global IMU Market, by Component, 2018, (Unit) (USD Million)

1.4.2. Global IMU Market, by Technology, 2018, (Unit) (USD Million)

1.4.3. Global IMU Market, by Grade, 2018, (Unit) (USD Million)

1.4.4. Global IMU Market, by Application, 2018, (Unit) (USD Million)

1.4.5. Global IMU Market, by Region, 2018 (Unit) (USD Million)

1.5. Premium Insights

1.5.1. IMU Market In Developed Vs. Developing Economies, 2018 vs 2026

1.5.2. Global IMU Market: Regional Life Cycle Analysis

Chapter 2 Market Dynamics

2.1. Market Overview

2.2. Market Drivers

2.2.1. Growing demand for accuracy in navigation

2.2.2. Increase in demand for aircraft and missiles due to changing nature of warfare

2.3. Market Restraints

2.3.1. High operational and maintenance costs along operational complexity

2.3.2. Less defense budget in developing countries

2.4. Market Opportunities

2.4.1. Continuous development in commercial driverless vehicles and MEMS-Based IMU

2.5. Industry Value Chain Analysis

2.6. Pricing Analysis

2.7. Porter’s Five Forces Analysis

Chapter 3 Global IMU Market, by Component

3.1. Market Overview, by Component

3.1.1. Global IMU Market, by Country, 2016-2026 (Unit) (USD Million)

3.1.2. Incremental Opportunity, by Component, 2018

3.2. Accelerometers

3.2.1. Global IMU Market, by Accelerometers, 2016-2026, (Unit) (USD Million)

3.3. Gyroscopes

3.3.1. Global IMU Market, by Gyroscopes, 2016-2026, (Unit) (USD Million)

3.4. Magnetometers

3.4.1. Global IMU Market, by Magnetometers, 2016-2026, (Unit) (USD Million)

Chapter 4 Global IMU Market, by Technology

4.1. Market Overview, by Technology

4.1.1. Global IMU Market, by Technology, 2016-2026 (Unit) (USD Million)

4.1.2. Incremental Opportunity, by Technology, 2018

4.2. Mechanical Gyro

4.2.1. Global IMU Market, by Mechanical Gyro, 2016-2026, (Unit) (USD Million)

4.3. Ring Laser Gyro

4.3.1. Global IMU Market, by Ring Laser Gyro, 2016-2026, (Unit) (USD Million)

4.4. Fiber Optics Gyro

4.4.1. Global IMU Market, by Fiber Optics Gyro, 2016-2026, (Unit) (USD Million)

4.5. MEMS

4.5.1. Global IMU Market, by MEMS, 2016-2026, (Unit) (USD Million)

4.6. Others

4.6.1. Global IMU Market, by Others, 2016-2026, (Unit) (USD Million)

Chapter 5 Global IMU Market, by Grade

5.1. Market Overview, by Grade

5.1.1. Global IMU Market, by Grade, 2016-2026 (Unit) (USD Million)

5.1.2. Incremental Opportunity, by Grade, 2018

5.2. Marine Grade

5.2.1. Global IMU Market, by Marine Grade, 2016-2026, (Unit) (USD Million)

5.3. Navigation Grade

5.3.1. Global IMU Market, by Navigation Grade, 2016-2026, (Unit) (USD Million)

5.4. Tactical Grade

5.4.1. Global IMU Market, by Tactical Grade, 2016-2026, (Unit) (USD Million)

5.5. Space Grade

5.5.1. Global IMU Market, by Space Grade, 2016-2026, (Unit) (USD Million)

5.6. Commercial Grade

5.6.1. Global IMU Market, by Commercial Grade, 2016-2026, (Unit) (USD Million)

Chapter 6 Global IMU Market, by Application

6.1. Market Overview, by Application

6.1.1. Global IMU Market, by Application, 2016-2026 (Unit) (USD Million)

6.1.2. Incremental Opportunity, by Application, 2018

6.2. Aerospace & Defense

6.2.1. Global IMU Market, by Aerospace & Defense, 2016-2026, (Unit) (USD Million)

6.3. Marine

6.3.1. Global IMU Market, by Marine, 2016-2026, (Unit) (USD Million)

6.4. Automotive

6.4.1. Global IMU Market, by Automotive, 2016-2026, (Unit) (USD Million)

6.5. Consumer Electronics

6.5.1. Global IMU Market, by Consumer Electronics, 2016-2026, (Unit) (USD Million)

6.6. Others

6.6.1. Global IMU Market, by Others, 2016-2026, (Unit) (USD Million)

Chapter 7 Global IMU Market, by Region

7.1. Market Overview, by Region

7.1.1. Global IMU Market, by Region, 2016-2026, (Unit) (USD Million)

7.2. Attractive Investment Opportunity, by Region, 2018

7.3. North America IMU Market

7.3.1. North America IMU Market, by Component, 2016-2026 (Unit) (USD Million)

7.3.2. North America IMU Market, by Technology, 2016-2026 (Unit) (USD Million)

7.3.3. North America IMU Market, by Grade, 2016-2026 (Unit) (USD Million)

7.3.4. North America IMU Market, by Application, 2016-2026 (Unit) (USD Million)

7.3.5. United States IMU Market, 2016-2026 (Unit) (USD Million)

7.3.6. Canada IMU Market, 2016-2026 (Unit) (USD Million)

7.4. Europe IMU Market

7.4.1. Europe IMU Market, by Component, 2016-2026 (Unit) (USD Million)

7.4.2. Europe IMU Market, by Technology, 2016-2026 (Unit) (USD Million)

7.4.3. Europe IMU Market, by Grade, 2016-2026 (Unit) (USD Million)

7.4.4. Europe IMU Market, by Application, 2016-2026 (Unit) (USD Million)

7.4.5. United Kingdom IMU Market, 2016-2026 (Unit) (USD Million)

7.4.6. Germany IMU Market, 2016-2026 (Unit) (USD Million)

7.4.7. France IMU Market, 2016-2026 (Unit) (USD Million)

7.4.8. Rest of Europe IMU Market, 2016-2026 (Unit) (USD Million)

7.5. Asia Pacific IMU Market

7.5.1. Asia Pacific IMU Market, by Component, 2016-2026 (Unit) (USD Million)

7.5.2. Asia Pacific IMU Market, by Technology, 2016-2026 (Unit) (USD Million)

7.5.3. Asia Pacific IMU Market, by Grade, 2016-2026 (Unit) (USD Million)

7.5.4. Asia Pacific IMU Market, by Application, 2016-2026 (Unit) (USD Million)

7.5.5. China IMU Market, 2016-2026 (Unit) (USD Million)

7.5.6. Japan IMU Market, 2016-2026 (Unit) (USD Million)

7.5.7. India IMU Market, 2016-2026 (Unit) (USD Million)

7.5.8. Rest of Asia Pacific IMU Market, 2016-2026 (Unit) (USD Million)

7.6. Latin America IMU Market

7.6.1. Latin America IMU Market, by Component, 2016-2026 (Unit) (USD Million)

7.6.2. Latin America IMU Market, by Technology, 2016-2026 (Unit) (USD Million)

7.6.3. Latin America IMU Market, by Grade, 2016-2026 (Unit) (USD Million)

7.6.4. Latin America IMU Market, by Application, 2016-2026 (Unit) (USD Million)

7.6.5. Brazil IMU Market, 2016-2026 (Unit) (USD Million)

7.6.6. Mexico IMU Market, 2016-2026 (Unit) (USD Million)

7.6.7. Rest of Latin America IMU Market, 2016-2026 (Unit) (USD Million)

7.7. Middle East & Africa IMU Market

7.7.1. Middle East & Africa IMU Market, by Component, 2016-2026 (Unit) (USD Million)

7.7.2. Middle East & Africa IMU Market, by Technology, 2016-2026 (Unit) (USD Million)

7.7.3. Middle East & Africa IMU Market, by Grade, 2016-2026 (Unit) (USD Million)

7.7.4. Middle East & Africa IMU Market, by Application, 2016-2026 (Unit) (USD Million)

7.7.5. GCC IMU Market, 2016-2026 (Unit) (USD Million)

7.7.6. Rest of Middle East & Africa IMU Market, 2016-2026 (Unit) (USD Million)

Chapter 8 Competitive Intelligence

8.1. Top 5 Players Comparison

8.2. Market Positioning of Key Players, 2018

8.3. Market Players Mapping

8.3.1. By Component

8.3.2. By Technology

8.3.3. By Grade

8.3.4. By Application

8.3.5. By Region

8.4. Strategies Adopted by Key Market Players

8.5. Recent Developments in the Market

8.5.1. Mergers & Acquisitions, Partnership, New Component Developments

Chapter 9 Company Profiles

9.1. Northrop Grumman

9.1.1. Northrop Grumman Overview

9.1.2. Northrop Grumman Components Portfolio

9.1.3. Northrop Grumman Financial Overview

9.1.4. Northrop Grumman News/Recent Developments

9.2. Thales

9.2.1. Thales Overview

9.2.2. Thales Components Portfolio

9.2.3. Thales Financial Overview

9.2.4. Thales News/Recent Developments

9.3. TELEDYNE TECHNOLOGIES

9.3.1. TELEDYNE TECHNOLOGIES Overview

9.3.2. TELEDYNE TECHNOLOGIES Components Portfolio

9.3.3. TELEDYNE TECHNOLOGIES Financial Overview

9.3.4. TELEDYNE TECHNOLOGIES News/Recent Developments

9.4. LORD MicroStrain

9.4.1. LORD MicroStrain Overview

9.4.2. LORD MicroStrain Components Portfolio

9.4.3. LORD MicroStrain Financial Overview

9.4.4. LORD MicroStrain News/Recent Developments

9.5. Honeywell

9.5.1. Honeywell Overview

9.5.2. Honeywell Components Portfolio

9.5.3. Honeywell Financial Overview

9.5.4. Honeywell News/Recent Developments

9.6. Safran Electronics & Defense

9.6.1. Safran Electronics & Defense Overview

9.6.2. Safran Electronics & Defense Components Portfolio

9.6.3. Safran Electronics & Defense Financial Overview

9.6.4. Safran Electronics & Defense News/Recent Developments

9.7. Bosch Sensortec GmbH

9.7.1. Bosch Sensortec GmbH Overview

9.7.2. Bosch Sensortec GmbH Components Portfolio

9.7.3. Bosch Sensortec GmbH Financial Overview

9.7.4. Bosch Sensortec GmbH News/Recent Developments

9.8. Moog Inc.

9.8.1. Moog Inc. Overview

9.8.2. Moog Inc. Components Portfolio

9.8.3. Moog Inc. Financial Overview

9.8.4. Moog Inc. News/Recent Developments

9.9. Trimble Navigation

9.9.1. Trimble Navigation Overview

9.9.2. Trimble Navigation Components Portfolio

9.9.3. Trimble Navigation Financial Overview

9.9.4. Trimble Navigation News/Recent Developments

9.10. Gladiator Technologies

9.10.1. Gladiator Technologies Overview

9.10.2. Gladiator Technologies Components Portfolio

9.10.3. Gladiator Technologies Financial Overview

9.10.4. Gladiator Technologies News/Recent Developments

Chapter 10 Preface

10.1. Data Triangulation

10.2. Research Methodology

10.2.1. Phase I – Secondary Research

10.2.2. Phase II – Primary Research

10.2.3. Phase III – Expert Panel Review

10.2.4. Approach Adopted

10.2.4.1. Top-Down Approach

10.2.4.2. Bottom-Up Approach

10.2.5. Supply- Demand side

10.2.6. Breakup of the Primary Profiles