Artificial Intelligence (AI) in BFSI Market Size

Global Artificial Intelligence in BFSI Market was valued at approximately USD 6.7 Billion in 2019 and is expected to grow US$ 28.63 Bn with a CAGR of 28.4% by 2027

The Integration of AI in BFSI Market is providing an edge to the early adopters and is strengthening their core competencies. The implementation of Artificial Intelligence will improve banking, insurance, and financial services in the upcoming years, positively impacting fraud mitigation, customer service, credit scores, and investment advisories.

Some of the major advantages of implementing artificial intelligence in BFSI Market are tailored customer experience, fraud detection, automated back-end processes, and better turn-around time.

Some of the early adopters of chatbot and voicebot are Bank of America, Commonwealth Bank of Australia, MasterCard, Capital One, and OCBC Bank Singapore. Chatbot can help answer FAQs and basic information. In addition to these, BFSI Market players are outsourcing these technologies, as in-house development may lead to extra overheads. The Key companies in chatbot and voicebot technology development are Facebook, Amazon, and many other budding startups.

The Bank of America’s Erica, a voicebot, investigates customers’ withdrawal history to measure their spending scenario and inform the status of the account if the balance is low. It also suggests solutions such as sending notification and transferring funds. The Commonwealth Bank of Australia’s Bot executes 200+ banking tasks for customers, such as paying bills, activating cards, sending bank statements, etc. In 2018, the Commonwealth Bank provided service to 6.2 million NetBank and CommBank app users.

MasterCard implemented FB Messenger’s chatbot to provide account balance, purchase history, and spending habits of customers. CapitalOne uses voicebot ENO’s skill to Amazon’s Alexa, allowing customers to use the service on their Alexa app and interact with it regarding their credit card bills, account balance, etc. ENO is also accessible over smartphone-based chat.

Risk and compliance monitoring companies are using AI frameworks for audio and video recordings of interactions between clients and bankers and are trying to identify banking terms that are usually monitored by auditors. For instance, Danske Bank has implemented an AI Framework which improved its fraud detection rate by 60%. In addition, Paypal has developed a fraud detection engine using Open-Source tools, which works on data mining, machine learning, and human intelligence, and the outcomes helped detect frauds.

The key and positive trends of the segment include:

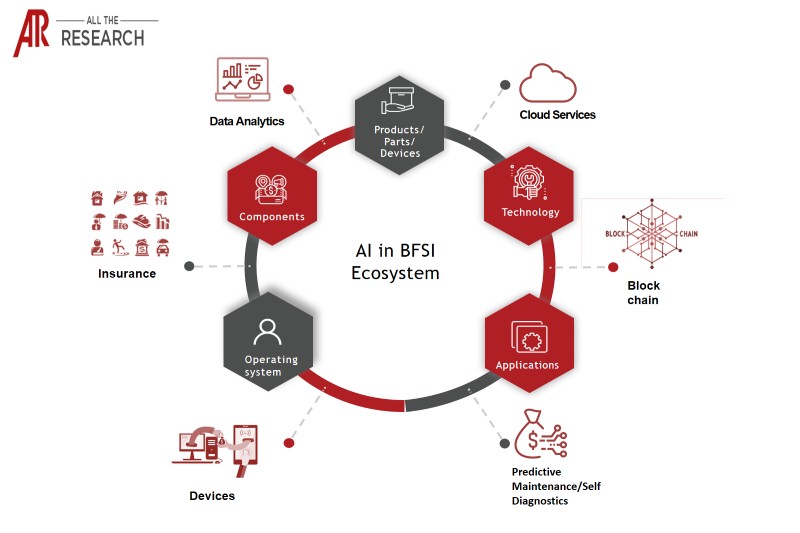

The report incorporates the study of the AI in BFSI that focuses on the Components, Offering, Application, Technology, Deployment and Devices operated in the business. Major players supply-side operating in the space of artificial intelligence in BFSI include Amazon Web Services (AWS), Inc., Avaamo, Inc., Baidu, Inc., Cape Analytics, LLC., CognitiveScale, Inc., Comply Advantage, Descartes Labs, Inc., Digital Reasoning, Inc., Google LLC, Inbenta Technologies, Inc. Intel Corporation, Interaction LLC, Ipsoft, Inc., Lexalytics, Inc., Microsoft Corporation, NEXT IT, Oracle Corporation, Palantir Technologies, Inc., Salesforce.com, Inc., SAP SE, and ZestFinance, Inc.

Report Scope:

A study is an effective tool for addressing Research insights relevant for business strategies like:

The market segments are identified and analyzed keeping in mind the Artificial Intelligence in BFSI market are given below:

By Components

By Offering

By Application

By Technology

By Deployment

By Devices

Regional Overview

Globally, artificial intelligence in BFSI Market is growing rapidly with the advent of technology and the availability of the infrastructure. Currently, North America holds the largest share in the artificial intelligence market and is expected to dominate the global market in the coming years. Within North America, U.S. held the largest share in the market, primarily due to the increasing number of investments in the fintech sector and rising implementation of AI-based solutions by major U.S. based banks including Bank of America Corporation, Wells Fargo & Company, JPMorgan Chase & Company, and U.S. Bancorp, among others. Companies are focusing on automation and optimal utilization of resources, as well as working on a customer-centric approach to improve banking offerings. However, APAC is anticipated to be the fastest-growing region and is expected to lead the market over the forecast period. This is attributed to the shift toward digitization by the financial sector, and the demand for personalized customer service in the region.

The major players operating in the global AI in BFSI Market are as follows:

|

Company |

Market Positioning |

Total Revenue |

Industry |

Region |

|

MasterCard |

Service Provider |

$14.95 Billion |

Information Technology |

Global |

|

IBM |

Service Provider |

$79.60 Billion |

Information Technology |

Global |

|

PayPal |

Service Provider |

$15.45 Billion |

Financial Services |

Global |

|

JP Morgan Chase |

Service Provider |

$109.03 Billion |

Financial Services |

Global |

|

Bank of America |

Service Provider |

$28.15 Billion |

Financial Services |

Global |

Very few markets have the interconnectivity with other markets like AI. Our Interconnectivity module focuses on the key nodes of heterogeneous markets in detail. Data analytics, Cloud Computing, and Blockchain markets are some of our key researched markets.

Artificial Intelligence Major Interconnectivities Ecosystem

COVID-19 Impact on the Global Artificial Intelligence in BFSI Market

The COVID-19 pandemic is expected to moderately impact the global artificial intelligence in BFSI market for a short-term period. The level of investment with regards to AI in BFSI has reduced due to the lockdown in almost every region, as it requires major capital investments. COVID-19 is expected to impact this market by the year-end 2020.

A Glance on the Global AI in BFSI Market Trends:

Ask for free product review call with the author

Share your specific research requirements for a customized report

Request for due diligence and consumer centric studies

Request for study updates, segment specific and country level reports